Courtesy: Wheaton Precious Metals

Investment Thesis

Wheaton Precious Metals (WPM) that I lined not too long ago on this preceding article concerning the third quarter of 2018 is a valuable metals streamer which gives crucial financing for conventional miners and permits them to finish infrastructure and to start mining operations commercially.

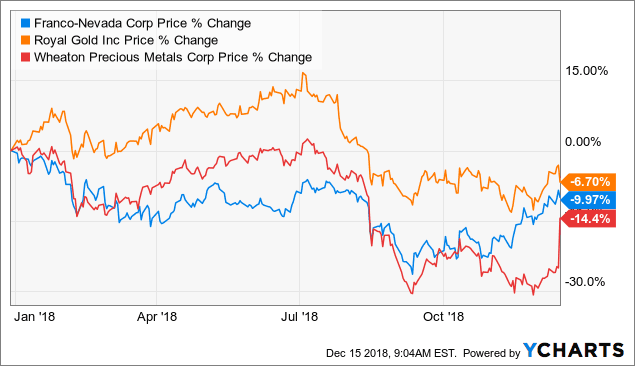

As a reminder, we are able to evaluate Wheaton Precious Metals to Franco-Nevada (FNV) or Royal Gold (RGLD) which I lined not too long ago as properly.

Source: Presentation November 2018

The Canadian streamer has underperformed its friends due to one Canadian extreme Tax situation that has plagued the corporate for a lot of months.

Wheaton Precious Metals has been preventing towards the Canadian Revenue Agency, CRA for brief, due to a dispute associated to revenue earned by the corporate’s offshore subsidiaries, the place the corporate takes supply of its valuable metals earnings.

The CRA argues that all the revenues generated by its international entities are taxable below Canadian legislation, and WPM was contesting that declare actively, and at last final week agreed to a good settlement with the tax authorities.

FNV knowledge by YCharts

FNV knowledge by YChartsThere is little doubt in my thoughts that WPM is a stock that must be thought-about as an extended-time period funding and I used this weak spot to build up the corporate at a sizeable low cost and really useful it on Seeking Alpha.

However, to maximise your revenue, I all the time suggest buying and selling about 30% of your place utilizing the volatility of the gold sector.

On December 13, 2018, Wheaton Precious Metals introduced that it had reached an settlement with the Canadian Tax Authorities.

Wheaton Precious Metals introduced that:

It has reached a settlement with the Canada Revenue Agency (“CRA”) which gives for a remaining decision of Wheaton’s tax enchantment in reference to the reassessment below switch pricing guidelines of the 2005 to 2010 taxation years (the “Reassessments”) associated to revenue generated by the Company’s wholly-owned international subsidiaries (“Wheaton International”) outdoors of Canada.

Wheaton’s President and Chief Executive Officer stated:

This settlement removes uncertainty with using our enterprise mannequin going ahead and places the tax situation behind us in order that we are able to proceed to deal with what we do greatest: constructing and managing our excessive-high quality portfolio each organically and by accretive acquisitions, as we did earlier this 12 months with the transactions on Vale’s Voisey’s Bay Mine and Sibanye’s Stillwater Mines.

Settlement Highlights

- Foreign revenue on earnings generated by Wheaton International is not going to be topic to tax in Canada.

- The service payment charged by Wheaton for the providers supplied to Wheaton International can be adjusted to:

- embody capital-elevating prices related to Wheaton for funding streaming transactions entered into by Wheaton International; and

- enhance the markup utilized to Wheaton’s price of offering providers to Wheaton International, together with the above capital-elevating prices, from the present 20% to 30%.

This extra service payment will end in elevated revenue generated by Wheaton in Canada that’s topic to Canadian tax.

- Transfer pricing penalties within the Reassessments can be reversed. Interest can be adjusted consequentially to the changes described above, topic to some minor changes.

- These switch pricing ideas will even apply to all taxation years after 2010, together with the 2011 to 2015 taxation years that are at the moment below audit and on a go ahead foundation.

After the appliance of non-capital losses, Wheaton doesn’t anticipate any extra money taxes will come up in respect of the 2005 to 2010 taxation years on account of the settlement.

Conclusion and Technical Analysis

In brief, Wheaton received vindicated and might declare complete victory:

1 – Foreign revenue on earnings generated by its wholly owned subsidiary referred to as “Wheaton International” is not going to be topic to tax in Canada.

2 – Also, service charges charged by the corporate to “Wheaton International” can be adjusted each to incorporate capital-elevating prices, and to extend the markup utilized to its price of offering providers to the worldwide subsidiary to 30% (from 20% at the moment).

The direct consequence of this definitive settlement may be very constructive for Wheaton:

- The firm’s tax situation has been put behind and solved with minor adjustments in regards to the monetary outlook.

- The firm can pay just a bit extra tax, as a result of increased revenue made by Wheaton topic to Canadian taxes.

- However, essentially the most thrilling takeaway for shareholders is that Wheaton confirmed that it does not count on extra taxes for its 2005 to 2010 taxation years deriving from the brand new settlement.

The firm can freely deal with the true enterprise, and hunt for brand spanking new streaming offers that are thought-about accretive acquisitions to profit shareholders.

For traders like me who used a lot of the chance arising from the latest stock slide, it was not an actual shock. As a reminder, on September 26, 2018, Cameco Corporation (CCJ) announced,

[T]hat the Tax Court of Canada has dominated unequivocally in favour of the corporate in its dispute of the reassessments issued by Canada Revenue Agency (“CRA”) for the 2003, 2005 and 2006 tax years.

However, if we evaluate WPM to FNV or RGLD on this phase, the stock value on Friday continues to be exhibiting a barely undervalued scenario.

With a dividend yield of about 2% now, and a robust potential for future progress after the latest acquisition of Voisey Bay cobalt stream, and Stillwater (gold, platinum, and Palladium), I consider WPM is an extended-time period funding candidate.

Source: WPM Q3 Presentation

Source: WPM Q3 Presentation

Technical evaluation

WPM jumped on the information to above $19 on Friday and closed at $18.94, which continues to be depressed from $21.50 the stock was averaging within the second quarter of 2018. I took about 35% revenue on Friday at above $19 and can look forward to some retracement so as to add to my place once more.

I like to recommend WPM as a maintain with a possible new accumulation at or under $17.

Author’s observe: Do not overlook to observe me within the gold sector. Thank you on your help; I respect it. If you discover worth on this article and wish to encourage such continued efforts, please click on the “Like” button under as a vote of help. Thanks!

Disclosure: SmallCapsDaily has no enterprise relationship with any firm whose stock is talked about in this article. This article is NOT FINANCIAL ADVICE. We are NOT FINANCIAL ADVISORS. This article is for news / entertainment purposes only.