Element Solutions Inc (NYSE:ESI), a specialty chemicals maker, has recently been thrust into the spotlight after Bloomberg reported that the company is exploring a potential sale, causing its shares to surge. The company, which produces chemicals used in everything from electronics to automobiles, has reportedly engaged Bank of America and Goldman Sachs to evaluate interest from potential suitors. On the upside, ESI’s robust positioning in high-growth industries like AI, EVs, and advanced semiconductor manufacturing can provide acquirers with significant long-term growth opportunities. On the downside, softness in certain industrial segments and its exposure to cyclical markets could pose risks. Let us take this opportunity to dive deeper into the company and analyze the factors that make Element Solutions an appealing acquisition target for both strategic acquirers and private equity funds.

Strong Positioning In Emerging Electronics Markets

Element Solutions has positioned itself as a leader in the high-performance computing, AI, and electric vehicle (EV) markets through its advanced circuitry and semiconductor solutions. These sectors are experiencing rapid growth due to increasing demand for innovative technologies and components that can handle high computational loads. ESI’s capabilities in wafer-level packaging and advanced packaging technologies make it a critical supplier to semiconductor manufacturers and high-performance computing industries. The firm’s revenue from its Circuitry Solutions business grew over 20% organically in the second quarter, with strong demand from AI and EV markets driving volume growth. While the smartphone market has seen sluggish recovery, ESI has leveraged its diverse portfolio to capture new opportunities in non-traditional markets such as data centers and electric vehicles. This diversification mitigates the risks associated with the volatile consumer electronics market and provides a steady stream of high-margin revenue. For strategic acquirers looking to expand their footprint in the rapidly evolving electronics market, acquiring ESI could give them access to key technologies and customer relationships in these high-growth areas, making it a compelling proposition. Private equity funds, on the other hand, may see the potential to capitalize on the company's focus on innovation and technological leadership to drive further growth and achieve higher returns on investment.

Resilient Margins & Strong Cash Flow Generation

One of the most attractive aspects of Element Solutions as an acquisition target is its ability to generate strong cash flows and maintain resilient margins even in challenging market conditions. In the second quarter, the company delivered 21% adjusted EBITDA growth on just 4% organic sales growth, highlighting its ability to drive profitability through a favorable product mix and cost management initiatives. The company’s adjusted EBITDA margin expanded by 250 basis points, driven by strong growth in high-margin businesses like Circuitry Solutions and Energy Solutions. Despite headwinds in the industrial sector, the firm achieved double-digit margin expansion across its segments, largely due to its focus on high-value, high-margin applications and permanent cost reductions. This margin strength provides acquirers with confidence in ESI’s ability to maintain profitability, even in a soft macroeconomic environment. Strategic buyers could unlock synergies through further cost optimizations and revenue enhancements, while private equity funds would benefit from ESI’s predictable cash flow, making it an ideal candidate for a leveraged buyout (LBO). The company’s balance sheet is also improving, with a net leverage ratio of 3.2x expected to fall below 3x by year-end. For both types of buyers, these financial metrics suggest a lower risk profile and significant room for capital deployment and value creation.

Attractive Long-Term Growth Opportunities In Sustainability & Advanced Materials

Element Solutions has made significant investments in R&D and new capabilities that position it to capitalize on long-term growth trends in sustainability and advanced materials. For instance, the company is scaling up its nanocopper technology and investing in dye and package-attached solutions that are critical for next-generation electronics manufacturing. Additionally, ESI’s commitment to sustainability through its focus on energy-efficient solutions and its growth in the renewable energy sector, particularly in offshore wind and energy storage, opens up new markets that align with global trends toward cleaner, more sustainable technologies. With the semiconductor and electronics industries moving towards more sustainable practices, ESI’s advanced packaging solutions that support energy-efficient chip manufacturing will become increasingly valuable. Strategic acquirers with a focus on expanding their portfolio in green technologies and sustainable materials would find ESI’s innovation pipeline particularly compelling. Private equity funds looking to tap into long-term trends in sustainability could view ESI’s investments in R&D and its role as a critical supplier in sustainable electronics as a significant growth lever. Moreover, the company’s scale-up initiatives in fast-growing markets like India and its new research center further solidify its growth potential, providing acquirers with a clear pathway to expansion in emerging markets.

Final Thoughts

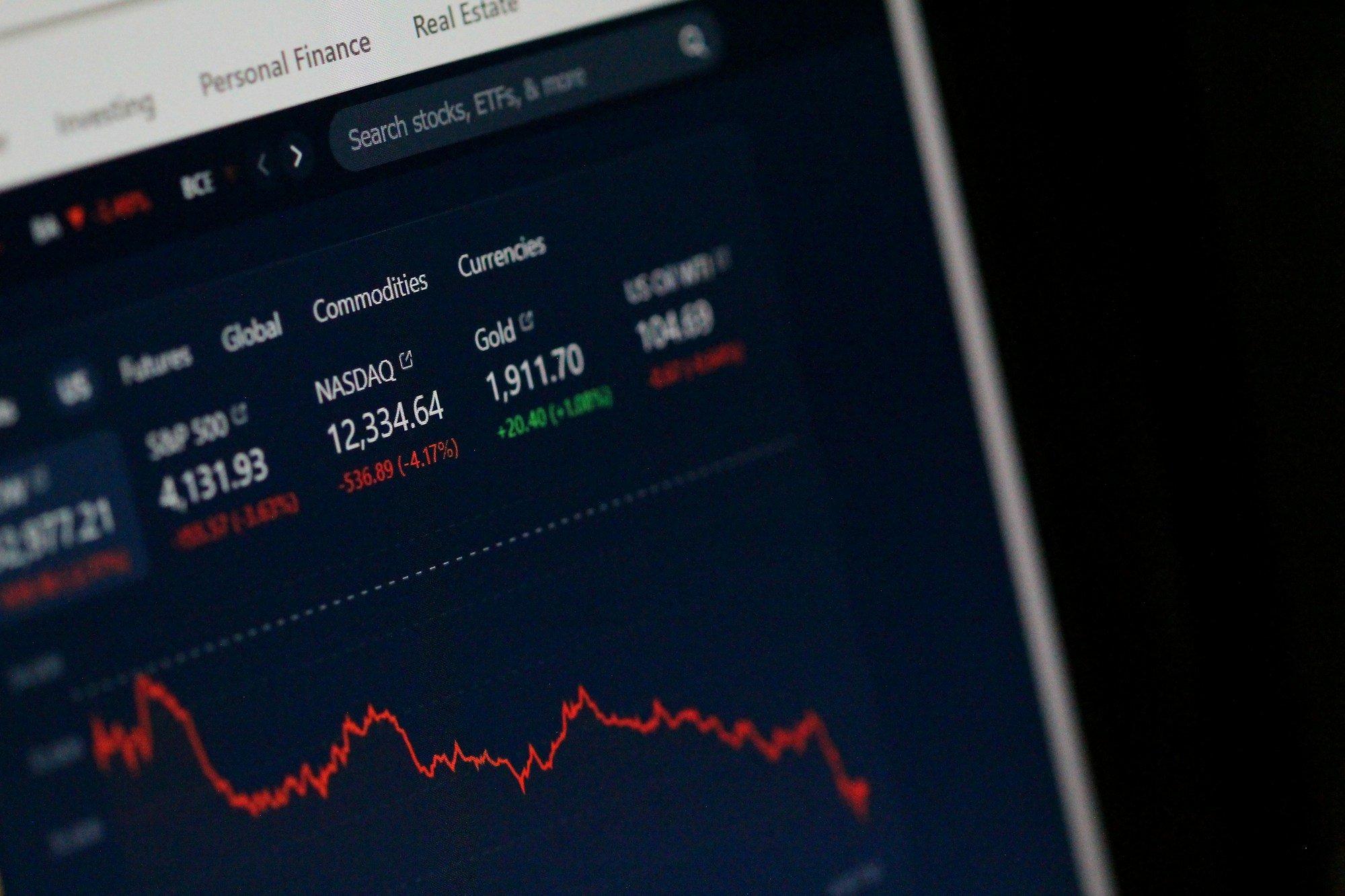

Source: Yahoo Finance

As we can see in the above chart, Element Solutions Inc’s stock price has been more or less flat over the past few months with a volatile trajectory which is largely a function of the fact that the rumors of the company exploring a sale have been out in the market since a while now. The company is trading at an LTM EV/ Revenue multiple of 3.33x and an LTM EV/EBITDA multiple of 16.12x making it fairly valued in comparison to peers. We believe that Element Solutions presents an intriguing acquisition opportunity for both strategic acquirers and private equity funds. Its leadership in high-growth electronics markets, strong cash flow generation, and long-term growth potential in sustainability and advanced materials make it a compelling target. However, acquirers should carefully evaluate the company’s exposure to cyclical markets and its dependence on specific sectors like smartphones and automobiles. As discussions are still in the early stages and there is no guarantee that a sale will materialize, we believe that a wait-and-watch approach is best suited for the stock of Element Solutions in the near term.

Responses (0 )