The latest ADP private-sector payroll report for May showed a steep slowdown in job creation, missing expectations largely. The economy added just 37,000 new jobs in the private sector, a stark miss compared to the projected 110,000. This marks the second consecutive month of disappointing job growth, following a revised 60,000 in April and the lowest monthly figure since March 2023.

Key Job Sector Trends and Breakdown

The ADP report showed a mixed picture across various job sectors, with some industries still adding positions while others saw declines. The goods-producing sector posted a modest loss of 2,000 jobs, continuing the trend of job shedding in industries such as manufacturing. Meanwhile, the services sector managed to generate a weak 36,000 jobs, marking a further deceleration in job creation.

- Leisure & Hospitality: +38,000 jobs: The leisure and hospitality sector continued to show resilience, with the addition of 38,000 jobs. This is a notable contribution, though not as strong as past months, especially in comparison to the post-pandemic rebound.

- Financial Services: +20,000 jobs: The financial services sector added 20,000 jobs, showing moderate growth, despite the broader slowing of hiring in other areas.

- Construction: +6,000 jobs: Construction added 6,000 jobs, signaling some stability in the sector, which remains critical to the overall labor market.

- Education & Health Services: -13,000 jobs: The normally reliable education and health services sector saw a decline of 13,000 jobs, raising concerns about the long-term stability of these key industries.

- Professional/Business Services: -27,000 jobs: This sector, which includes enterprise consulting and other professional services, saw a notable drop of 27,000 jobs, highlighting challenges in high-skill, high-wage occupations.

- Trade/Transportation/Utilities: -4,000 jobs: Job losses also extended to the trade, transportation, and utilities sector, which shed 4,000 positions, further complicating the employment landscape.

Employment Breakdown by Business Size

In terms of company size, the data shows stark differences in hiring patterns. Medium-sized businesses (those with 50 to 499 employees) led the way, adding 49,000 jobs. However, large firms (500+ employees) reduced their workforce by 3,000, and small businesses (fewer than 50 employees) shed 13,000 jobs. This decline in small business hiring is particularly concerning, as companies with fewer than 250 employees make up 70% of overall US employment.

Wage Growth and Job Market Stability

Despite the slowdown in hiring, wages continue to show signs of resilience. ADP’s data on “Job Stayers” versus “Job Changers” indicates that those who remain in their current positions saw wage growth of 4.5% year-over-year, while job changers enjoyed a higher increase of 7%. While not at the highs seen during the post-pandemic recovery, these figures still reflect healthy wage growth, suggesting that the labor market is stabilizing, albeit at a slower pace.

Nela Richardson, ADP’s chief economist, noted that the job market is not collapsing but is rather “hesitant.” She emphasized that while there are no “superheroes” in the market, which could dramatically lift hiring in specific sectors, there are no immediate signs of mass layoffs either. The market is adjusting, and despite the sluggish pace, the underlying economy appears to remain resilient.

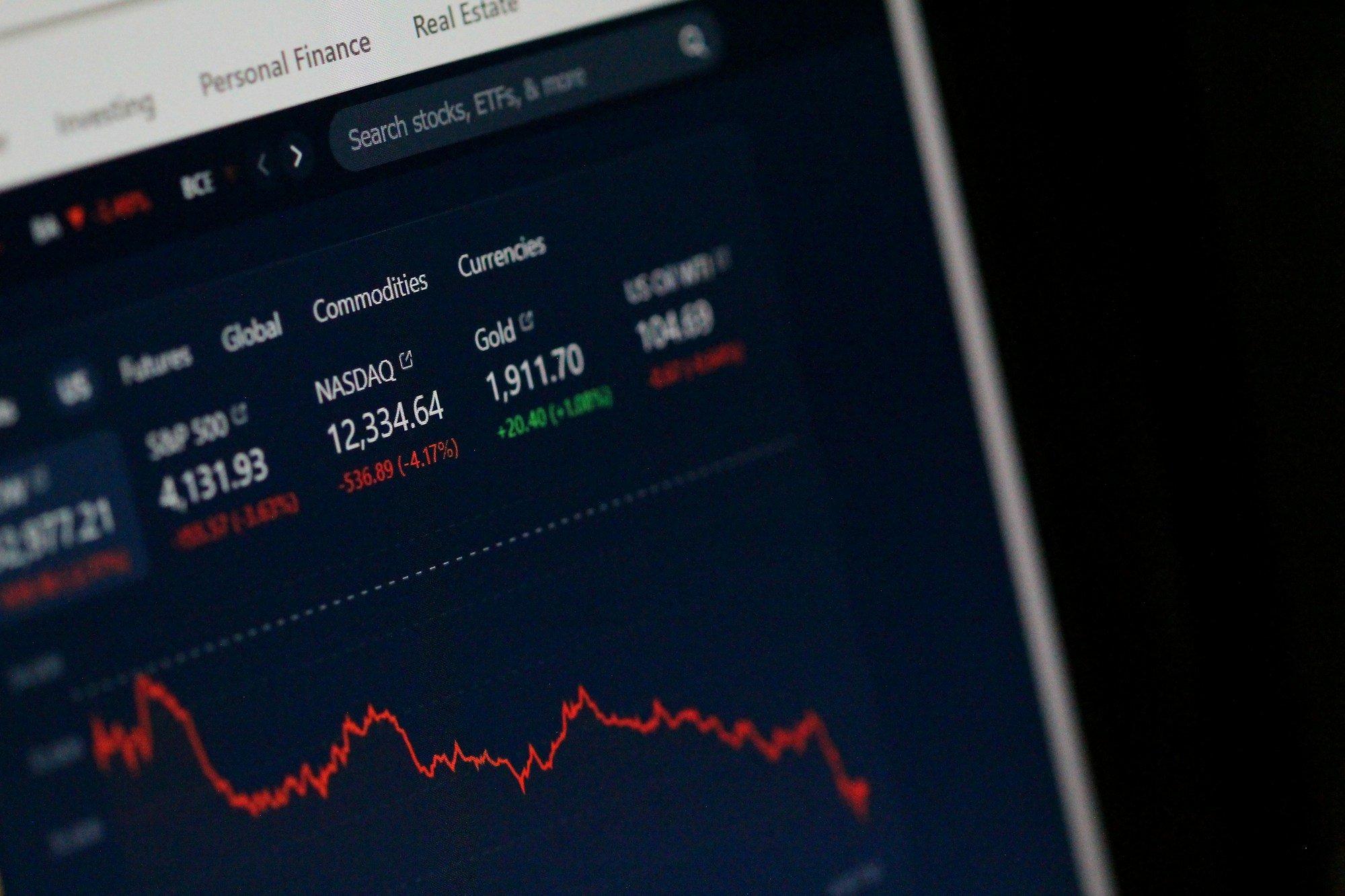

Market Reactions and Investor Sentiment

In the immediate aftermath of the report, US stock indices slipped into the red. The Dow Jones Industrial Average fell by 44 points, while the S&P 500 and Nasdaq also edged lower, down 4 and 20 points respectively. The small-cap Russell 2000 also saw a slight dip. Despite these losses, the major indexes are still showing modest gains for the month. However, the year-to-date performance remains mixed, with the S&P 500 up by 0.7%, while the Nasdaq has gained 2.2%, and the Russell 2000 has underperformed, down 6.5%.

The weak ADP report has led to growing uncertainty about the trajectory of the labor market and its impact on the broader economy. With upcoming economic data releases and the looming US Employment Report later in the week, all eyes will be on whether this slowdown in job growth is a temporary blip or a sign of deeper economic challenges.

Looking Ahead

Looking ahead, investors will be watching closely for further economic indicators that could provide more insight into the health of the labor market and the broader economy. The official US Employment Report for May, due out later this week, will be key in assessing whether the ADP data is an outlier or part of a larger trend of slowing job growth. Additionally, investors will be focused on the Federal Reserve’s next moves, particularly in light of ongoing concerns about inflation, economic growth, and the potential impact of the ongoing trade tensions with China. As the Fed continues to navigate its monetary policy, the labor market’s performance will remain a critical factor in shaping expectations for future rate hikes or cuts.

For now, the market remains in a cautious wait-and-see mode, with many investors unsure whether the recent slowdown in job growth is temporary or the start of a more prolonged deceleration. The coming weeks will likely bring further volatility as these key economic indicators continue to evolve.