Over the past year, Arista Networks (NYSE:ANET) has staged one of the most impressive comebacks on Wall Street, transforming from a stock marred by tariff fears and competitive pressures into a top AI infrastructure play. Shares plummeted nearly 50% earlier in 2025, weighed down by investor concerns around whitebox competition and macro uncertainty. But since April, the narrative has flipped dramatically. The catalyst? A strong Q1 2025 beat, promising AI exposure, and capital expenditure reaffirmations from hyperscale customers like Microsoft and Meta, which together drive over a third of Arista’s revenue. Not only did Arista post 27.6% YoY growth in Q1, but it also confidently reiterated its $1.5 billion AI-related revenue target for 2025—split evenly between front-end and back-end Ethernet infrastructure. With additional traction from Oracle and Tier-2 cloud providers, the company now sits at the center of multiple secular growth vectors. Here's a closer look at what has propelled Arista's stunning turnaround.

Betting Big—and Early—on Ethernet for AI

Arista’s transition into the AI age didn’t happen overnight. The company had been steadily developing a back-end AI Ethernet architecture well before ChatGPT lit up global interest in late 2022. That event became the company’s “aha moment,” according to CEO Jayshree Ullal. Historically, Arista dominated the front-end of cloud data centers, while back-end AI clusters were controlled by legacy InfiniBand setups. However, Arista moved quickly to challenge the status quo by championing Ultra Ethernet—a scalable, congestion-tolerant Ethernet solution purpose-built for AI workloads. By launching a family of Etherlink products and playing a founding role in the Ultra Ethernet Consortium, Arista positioned itself as the preferred alternative to InfiniBand, enabling high-speed, low-latency networking for massive GPU clusters. The product evolution has been bolstered by strong partnerships with NVIDIA and hyperscalers building 100K+ GPU AI clusters. With 3 of 4 large-scale AI pilots nearing production status in 2025, Arista expects $750 million in back-end Ethernet AI revenue this year alone. Even as whitebox players remain entrenched in specific hyperscaler environments, Arista’s differentiated Jericho-based spine architecture—offering best-in-class congestion management and power efficiency—has become a competitive moat in AI deployments. This early and bold investment into the Ethernet-based AI fabric is now paying off, shifting Arista from the sidelines to the heart of the next-gen data center buildout.

Software Superiority: EOS As The Secret Weapon

At the core of Arista’s long-term success is EOS (Extensible Operating System)—a modular, Linux-based networking software stack that has quietly become one of the industry’s most trusted platforms. While hardware differentiation is crucial, Arista’s ability to scale and manage complex data flows in real-time has hinged on its software edge. EOS is not just a switching OS; it's a data lake and automation layer that brings visibility, reliability, and programmable control across networks of all sizes. It supports sophisticated functions like zero-downtime upgrades, telemetry, latency analysis, and security observability through AVA (Autonomous Virtual Assistant), enabling enterprise and cloud customers to troubleshoot and optimize at scale. The same software stack that powered Arista’s rise in “classic cloud” now extends to AI workloads, where network traffic is far more volatile and computation-intensive. Tail latency, multi-sender-to-one-receiver flows, and extreme congestion patterns all require intelligent routing that EOS handles natively. Even in emerging AI partnerships, customers like Oracle cite EOS’s stability and modularity as key reasons to work with Arista. Moreover, Arista is now bringing software intelligence down to the host and NIC level—further strengthening its integrated value proposition. With 20 straight quarters of earnings beats and virtually no downtime on record, EOS has evolved from a competitive advantage into a foundational pillar of trust with enterprise, hyperscaler, and AI customers alike.

Strategic Execution Amid Tariff Turbulence

While many tech companies pulled back guidance or flagged macro uncertainty, Arista took a different approach. Instead of reacting to the potential 2025 tariff changes with caution, the company adopted a proactive, multi-pronged mitigation plan to maintain its margin profile and customer confidence. CFO Chantelle Breithaupt outlined three key strategies: supply chain fungibility, internal absorption of costs, and, if necessary, selective price increases. Arista has expanded manufacturing capacity in Mexico, Vietnam, and Malaysia to reduce dependency on China, ensuring USMCA compliance for North American deliveries. Meanwhile, the company built up inventory in Q1—raising it from $1.8 billion to $2 billion—to cushion any supply disruptions ahead of the July tariff decision. Despite the unknowns, Arista maintained its full-year 2025 guidance and reported a Q1 gross margin of 64%, significantly above its guided range of 60-62%. This level of supply chain foresight, operational agility, and pricing discipline reflects a company not only adept at engineering but also at managing global risk. While other vendors scrambled to adjust, Arista demonstrated how consistency in execution and transparent communication can win over investors in periods of geopolitical and macroeconomic stress. This resilience has further cemented the company's reputation and re-rated its valuation narrative.

From Niche To Mainstream: Campus & Enterprise Growth Engine

While AI and cloud tend to grab headlines, Arista has quietly built another high-growth engine in the enterprise and campus networking market. Representing roughly $16 billion of its total $70 billion addressable market, the campus segment was underpenetrated due to COVID-related delays and early portfolio gaps. That has changed in 2025. Arista has fully aligned its hardware, software, and go-to-market strategy to target campus deployments, with a specific emphasis on replacing legacy Cisco and Juniper infrastructure. What’s most telling is the company’s ability to now win campus-first deals—even without a data center footprint—indicating that its brand equity is expanding beyond traditional hyperscale buyers. With new sales hires, reseller investments, and EOS enhancements for branch automation and wireless-wireline convergence, the company has turned this previously dormant segment into a legitimate growth vector. Internally, leadership now devotes equal time to campus and AI opportunities, underscoring its strategic importance. Moreover, the cross-pollination between AI innovation and enterprise deployments—particularly in areas like observability, automation, and low-latency routing—has created synergies that few competitors can match. As customers look for alternatives to legacy incumbents, Arista’s campus push is helping diversify revenue, reduce customer concentration risk, and create new footholds across verticals, regions, and use cases.

Final Thoughts

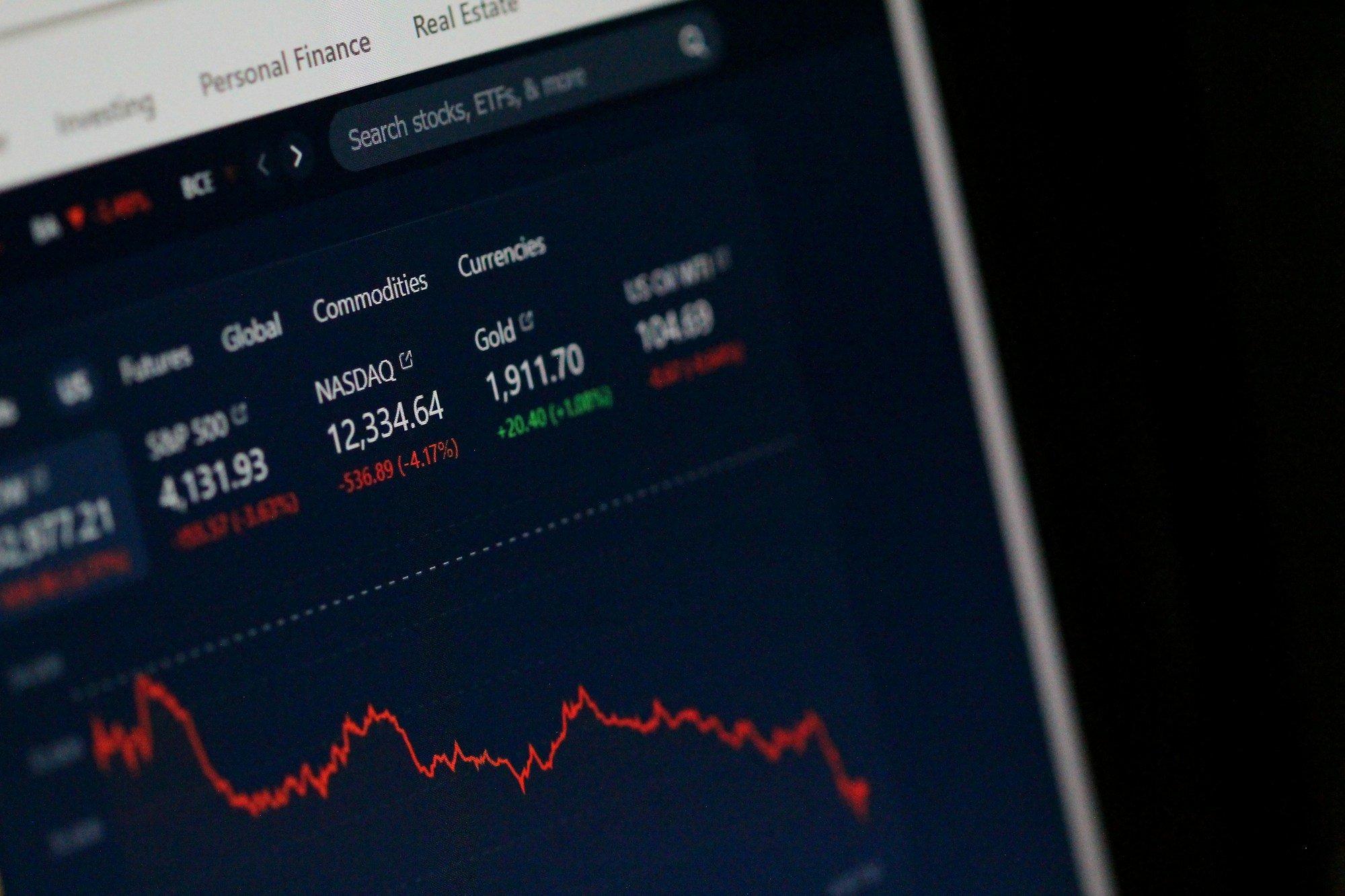

Source: Yahoo Finance

We can see a clear resurgence in Arista Networks’ stock price after April 2025. From a valuation standpoint, its LTM EV/ Revenue multiple is at a staggering 15.38x with a P/E of 41.04x. It is evident that the company has earned its place as a Wall Street darling not through hype, but through disciplined execution, relentless innovation, and smart strategic positioning. From scaling Ethernet in AI back-end deployments to fortifying its enterprise and campus footprint, Arista has evolved into a multi-segment leader with long-term tailwinds. Its software-first DNA, resilient supply chain, and expanding customer base give it leverage to weather short-term volatility while capitalizing on secular trends in AI, cloud, and enterprise modernization. However, investors should continue to monitor competitive developments in whitebox adoption, the implications of the July tariff ruling, and the execution timeline of key customer AI pilots. While the growth outlook appears robust, weighing both the opportunities and the risks is prudent. That said, Arista’s journey from being considered a company to avoid to now potentially commanding a $10 billion+ annual revenue run rate—years ahead of expectations—is a case study in strategic reinvention worth paying attention to.