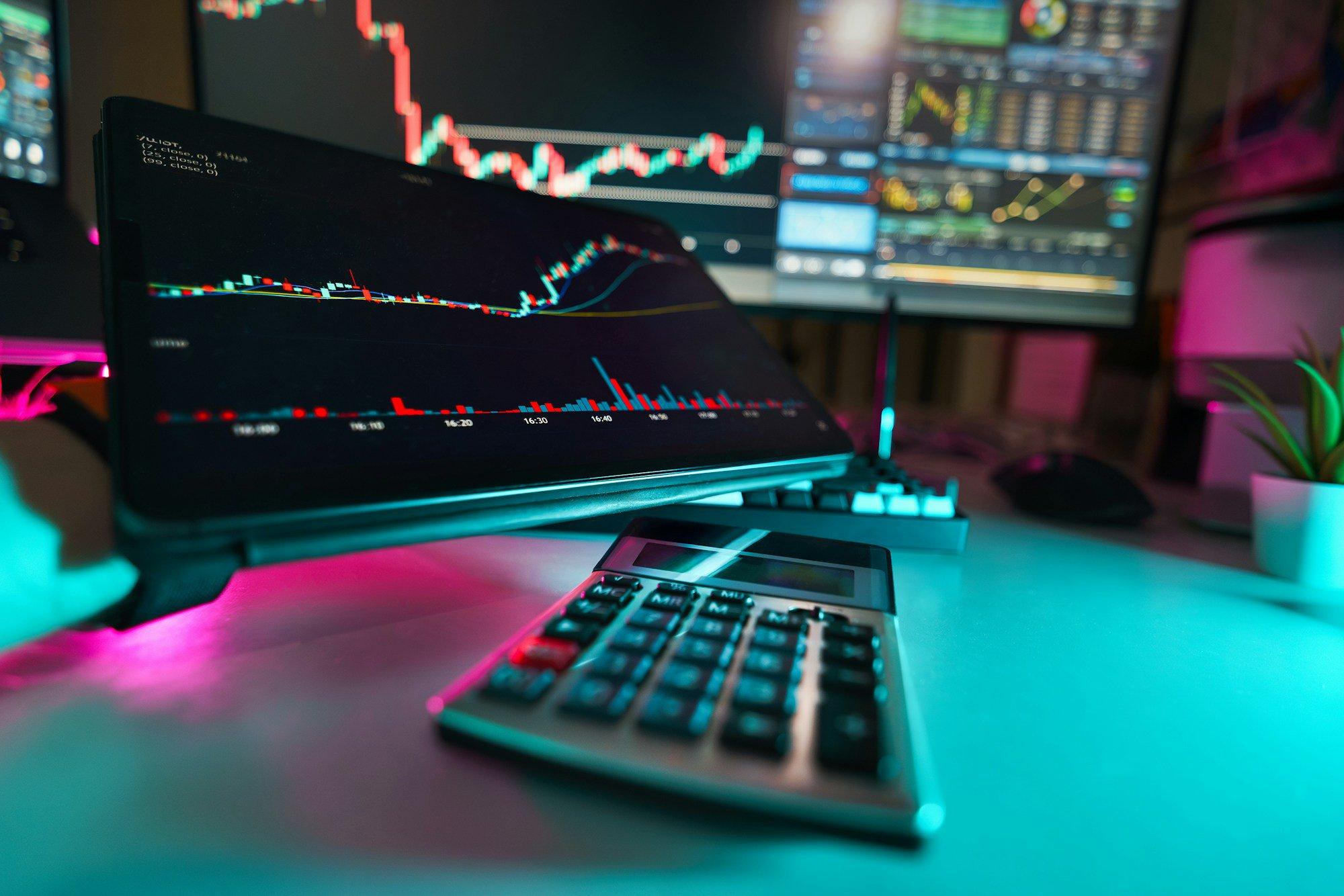

Bitcoin (BTC) fell to $67,000 on Thursday, marking its lowest level since October 2024 and extending a dive that has erased much of the rally tied to expectations of crypto-friendly U.S. policy. The world’s largest digital asset is now down more than 45% from last year’s peak, demonstrating how quickly sentiment has shifted across the cryptocurrency market.

The decline has unfolded alongside broader risk-off pressure in global markets, with equities, commodities, and alternative assets all experiencing heightened volatility. Coverage from major financial outlets suggests a convergence of forces, includingpolicy uncertainty, stretched positioning, and fading speculative momentum, driving the latest leg lower in digital assets.

ETF Positioning and Market Structure Weigh on Prices

One of the most persistent headwinds is the growing strain among exchange-traded fund investors who entered the market at significantly higher prices. Research cited across Wall Street suggests that many bitcoin ETF holders remain deeply underwater, with average entry levels near prior highs, which limits the likelihood of fresh institutional inflows in the near term. A similar pattern is emerging in Ethereum-linked funds, where losses have also grown. Analysts warn that when large pools of capital are trapped at higher cost bases, rallies can struggle to gain traction because selling pressure re-emerges as prices approach breakeven levels.

Policy Signals Undermine Bullish Expectations

Recent comments from U.S. officials have further lowered optimism. Treasury leadership signaled that the government lacks both the authority and intention to support cryptocurrency prices directly, cooling speculation that federal backing might provide a safety net for digital assets. At the same time, shifting expectations around Federal Reserve leadership and interest-rate policy have created an additional hurdle. A more hawkish macro backdrop typically pressures speculative assets, and cryptocurrencies have historically shown sensitivity to tighter financial conditions and rising real yields.

Bear-Market Warnings Grow Louder

Key market voices are now openly questioning bitcoin’s role as a hedge against currency debasement or financial instability. Instead, skeptics argue the asset behaves more like a high-beta speculative instrument, rising during periods of abundant liquidity and falling when conditions tighten.

Strategists tracking market cycles also note that bitcoin has logged multiple consecutive monthly declines, a pattern often associated with prolonged corrective phases rather than brief pullbacks. Without a clear catalyst — such as renewed institutional demand, regulatory breakthroughs, or easing monetary policy — downside risks may persist.

Broader Crypto Weakness Reflects Fragile Sentiment

The sell-off has not been limited to bitcoin. Ethereum and other major tokens have declined in tandem, reinforcing the sense of systemic weakness across the digital-asset ecosystem. Declining prices, reduced trading momentum, and cautious institutional positioning all point to a market still searching for stability. This fragility stands in contrast to earlier optimism that supportive regulation and political backing would usher in a sustained bull cycle. Instead, recent weeks have highlighted how dependent crypto valuations remain on liquidity, sentiment, and macro conditions.

Looking Ahead

The next phase for Bitcoin will likely hinge on macroeconomic direction and investor positioning. Clearer signals of monetary easing, renewed institutional inflows, or technological catalysts could help stabilize prices and rebuild confidence. Until then, volatility may remain elevated. With bitcoin hovering near multi-month lows and sentiment turning cautious, the crypto market appears to be entering a period defined less by speculation and more by resilience — a transition that could ultimately shape the next long-term trend.