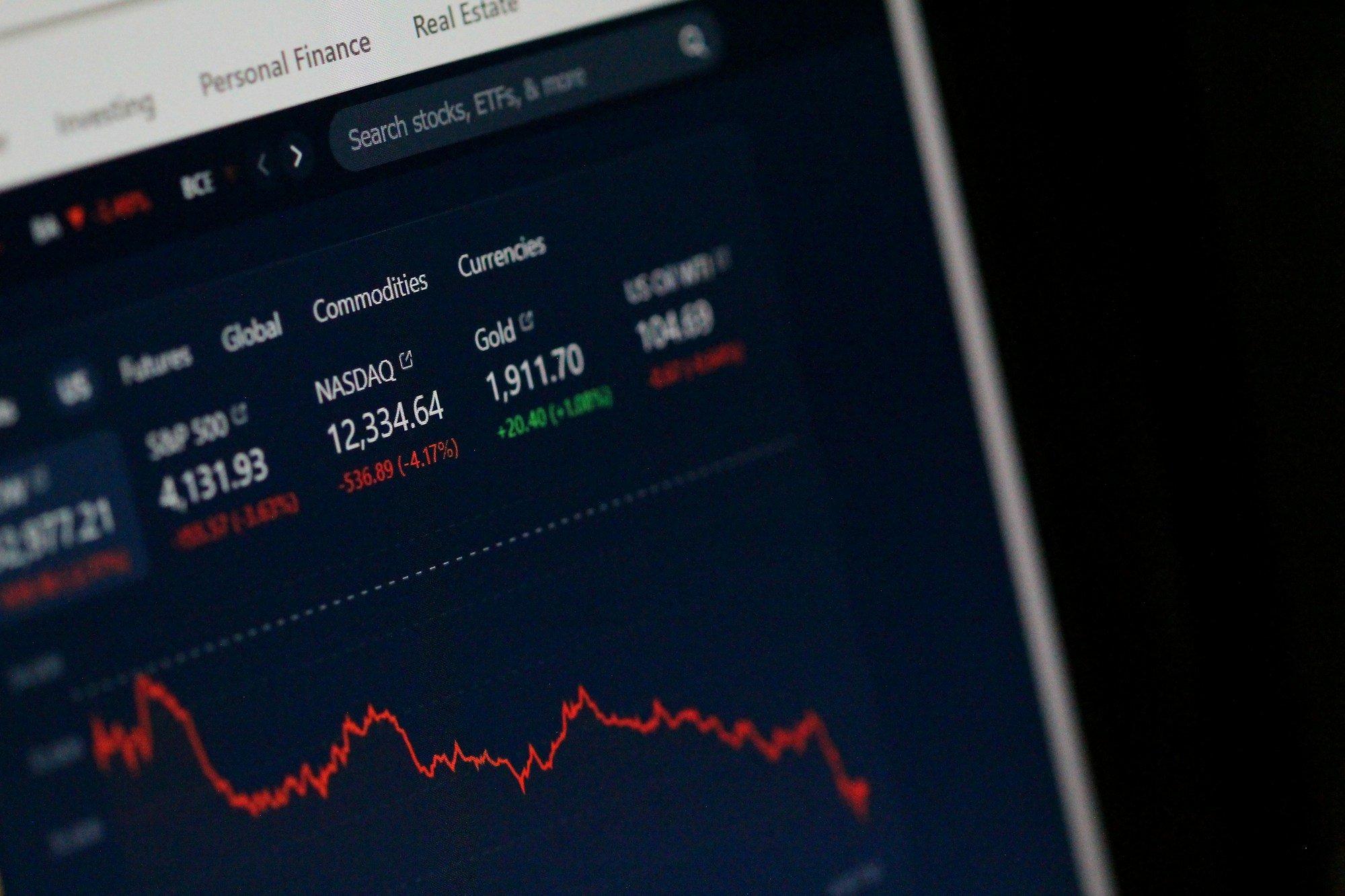

Bitcoin (BTC-USD) has been surging in value as companies have increasingly begun to integrate the cryptocurrency into their balance sheets, positioning it as a hedge against inflation. On Tuesday, Bitcoin climbed to a new high, nearing $109,000, just shy of its May all-time intraday peak. This surge in Bitcoin’s price shows the growing institutional interest and an overall favorable regulatory climate in the U.S., spurred by the Trump administration’s crypto-friendly policies. As the token's adoption continues to rise, many investors are betting on its potential as an inflationary hedge, further fueling its bullish momentum.

Corporate Adoption Drives Bitcoin’s Rise

A key factor behind Bitcoin’s recent price climb is the growing number of public companies that have embraced the cryptocurrency as part of their financial strategies. These companies view Bitcoin as a way to protect against inflation and diversify their investment portfolios. Elliot Johnson, CEO of Bitcoin Treasury Corp., noted that Bitcoin has outperformed traditional assets like gold, highlighting its more than 1,000% gain over the last five years compared to gold’s 92.5% return. With inflation eroding the value of the U.S. dollar, more companies are adding Bitcoin to their balance sheets, increasing the demand for the digital asset.

Currently, about 80 companies have adopted what’s being called the “Bitcoin standard,” holding approximately 3.4% of all Bitcoin in circulation. Among these, Strategy (MSTR) has emerged as a leader, with its Bitcoin treasury now valued at over $62 billion. Strategy’s recent purchase of an additional 1,045 Bitcoin from June 2 to June 8 sent its stock soaring by more than 4%. However, experts caution that the approach of holding Bitcoin as a treasury asset comes with significant risks, especially if Bitcoin’s value declines sharply.

Risks of Bitcoin Treasuries

Despite the optimistic outlook, some analysts warn of the potential dangers associated with running a leveraged Bitcoin treasury strategy. NYU Stern School of Business professor David Yermack pointed out that a rapid drop in Bitcoin’s price could result in significant financial instability for companies heavily invested in the token. Not every company will replicate the success of Strategy, whose scale is difficult to match, according to Bernstein analyst Gautam Chhugani.

In recent months, other companies have faced setbacks in their Bitcoin ventures. GameStop (GME) saw its stock tumble nearly 25% after announcing plans to raise $1.3 billion to purchase Bitcoin, and Trump Media & Technology Group (DJT) also experienced a sharp decline in share value after revealing its ambitions to create a large Bitcoin treasury. These examples highlight the volatile nature of Bitcoin and the risks companies face when adopting such an asset on their balance sheets.

Regulatory Support Fuels Optimism

The optimism surrounding Bitcoin is further fueled by the U.S. government’s stance on digital assets. President Trump’s administration has signaled strong support for the cryptocurrency space, including appointing a crypto-friendly advocate to head the Securities and Exchange Commission and establishing a crypto-czar. Additionally, legislation aiming to regulate stablecoins—digital assets pegged to traditional currencies like the U.S. dollar—has garnered strong bipartisan support, with Senate Republicans planning to pass the bill this week.

These regulatory developments have boosted investor confidence, as many believe that a clearer regulatory framework will provide more stability and legitimacy to the crypto industry. This is further reflected in Bitcoin’s price, which has surged by over 55% since Trump’s election, as the market anticipates the positive impact of these policies on the broader crypto landscape.

Looking Ahead

Bitcoin’s rally will likely continue as more companies adopt the cryptocurrency and regulatory clarity improves. However, volatility remains a key hurdle for investors, particularly as the price of the token fluctuates. The growing number of companies holding Bitcoin could provide support for its price, but the risk of a sharp correction remains. Investors will also be watching for updates on stablecoin legislation and further developments from the Trump administration, which could continue to shape the future of digital assets. As Bitcoin moves closer to its all-time highs, the path forward for the cryptocurrency will depend on both continued institutional adoption and favorable regulatory changes.