Crude oil prices faced pressure this Wednesday following the conclusion of COP28, where a historic agreement aimed at steering away from fossil fuels was reached. As we move into more sustainable options and the energy transition gains momentum, the future of oil remains in question, with market indicators showing significant shifts. This article explores the COP28 accord, its impact on oil prices, and the potential implications for investors in this evolving energy landscape.

The COP28 Accord: Shaping a Cleaner Future

The centerpiece of the COP28 agreement is a bold initiative to phase out fossil fuels and embrace renewable energy sources. This includes:

- Setting a timeline for phasing out coal: Developed countries agreed to end coal use by 2035, with developing countries aiming for 2040.

- Investing in renewable energy: A massive $10 trillion investment fund was established to support developing countries in transitioning to clean energy sources.

- Strengthening carbon pricing: Countries agreed to work towards implementing carbon pricing mechanisms to incentivize emissions reduction.

While the specifics of the agreement are still being negotiated, its ambitions are clear: to move the world away from its dependence on fossil fuels and towards a cleaner future.

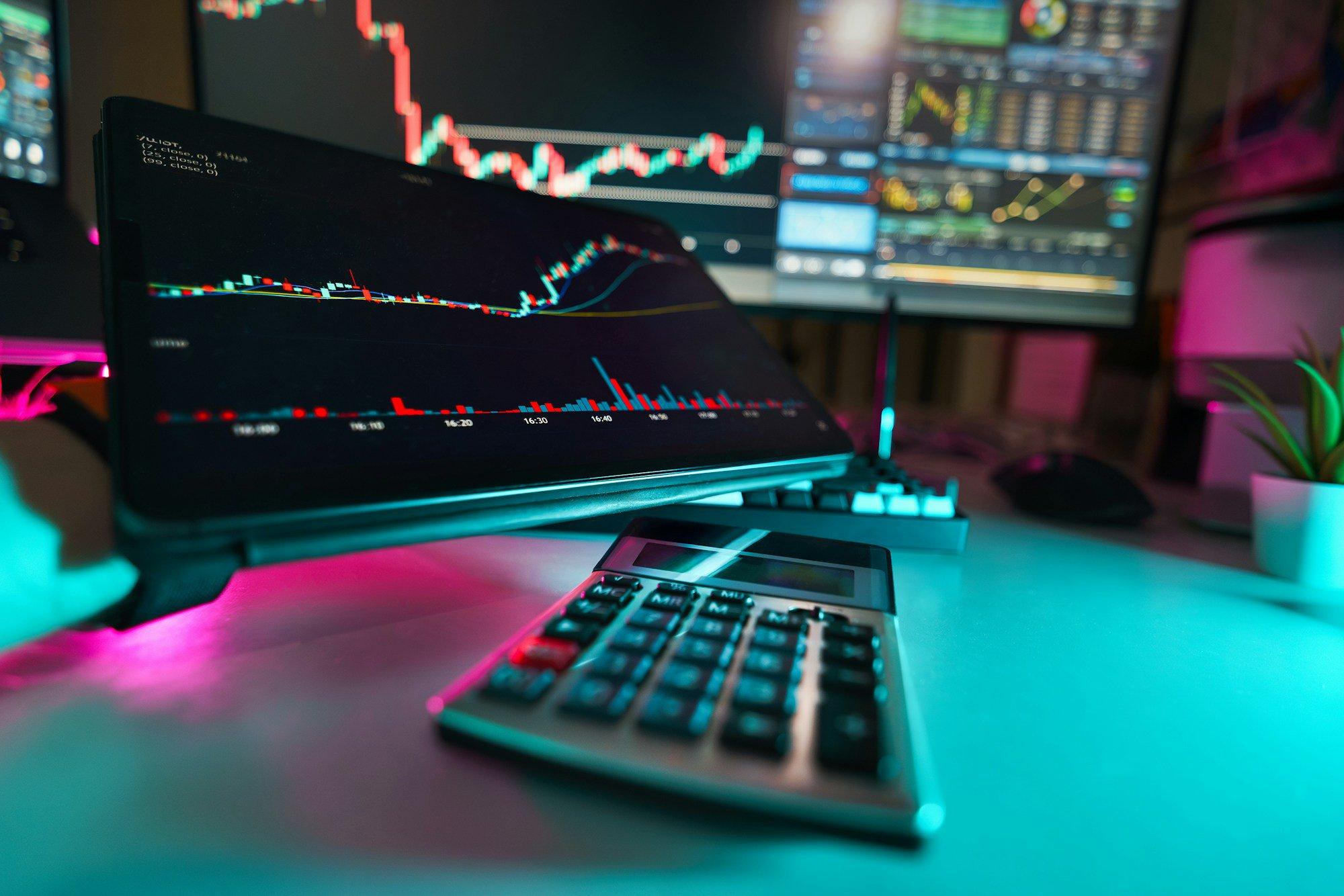

In the wake of the COP28 agreement, international benchmark Brent crude prices plummeted by 7%, signaling concerns about future fossil fuel demand. This downturn follows months of declining oil prices fueled by economic slowdown fears. However, the long-term impact on oil prices remains uncertain, hinging on factors such as the pace of the energy transition, technological advancements, and geopolitical considerations.

A Crack in the Black Gold Shell

The COP28 agreement is a crack in the once-dominant shell of oil's influence. Investors should consider the following:

1. Diversification: Opportunities arise in clean energy investments, including renewable energy companies and battery storage technologies.

2. Risk Assessment: Oil-centric companies face long-term risks, while those embracing renewable sources may be poised for growth.

3. Regulatory Changes: Stricter environmental regulations may impact the oil and gas industry.

The COP28 agreement signals an important and pivotal moment in the global energy landscape. While short-term oil price fluctuations may continue, the long-term trajectory hints at declining demand for fossil fuels. Investors adapting to this shift by diversifying into clean energy solutions are likely to navigate these uncharted waters more successfully.

Responses (0 )