The electric vehicle (EV) infrastructure landscape is rapidly shifting, and EVgo (NASDAQ:EVGO) appears poised to play offense. During its latest Q2 2025 earnings call, EVgo CEO Badar Khan stated that the company is “open to acquisitions,” a comment that coincides with mounting headwinds in the EV ecosystem. This development comes amid waning policy tailwinds—namely the countdown to the expiration of the federal 30C tax credit in June 2026—and growing evidence that many smaller EV charging providers are struggling to access capital in a higher-rate, tighter-liquidity environment. EVgo, by contrast, recently secured a landmark $225 million commercial bank facility with a 3.25% SOFR-based spread, while continuing to leverage its $1.25 billion DOE loan guarantee. With CapEx per stall falling 28% from original 2025 estimates and operational metrics trending positively, the company is signaling readiness to consolidate as less-resilient peers falter. But does it have the potential to create any kind of shareholder value by adopting this inorganic growth strategy? Let us find out!

Disciplined Capital Deployment And M&A Optionality

EVgo’s recent capital market activity underscores its focus on disciplined, non-dilutive financing that enhances flexibility. The $225 million commercial bank facility—led by SMBC and backed by banks like RBC, ING, and Bank of Montreal—complements its Department of Energy (DOE) loan, collectively allowing EVgo to scale without issuing equity. As of Q2 2025, EVgo had $183 million in cash (excluding the first drawdown from the facility and 30C tax credit monetization), a marked increase from prior quarters. The firm also anticipates generating up to $570 million in annual adjusted EBITDA by 2029 based on its accelerated stall build-out and operational improvements. Importantly, EVgo can now lever all new EVgo-owned stalls, including autonomous vehicle (AV) hub stalls that previously weren’t DOE-eligible, expanding its total addressable market for debt-financed growth. This strong balance sheet and asset-backed borrowing capacity provide a platform for potential acquisitions, especially of undercapitalized or geographically strategic charging networks. The absence of a time limit on the DOE loan's advance requests adds further optionality—enabling EVgo to absorb acquired assets now and refinance opportunistically later. Given the retreat of many competitors due to funding challenges or strategic pivots by parent companies, EVgo's dual-funding track opens the door for consolidation without overleveraging. With CapEx per stall declining and state-level grants offsetting up to 45% of costs in 2025, management’s capital stewardship is positioning the company as a credible acquirer amid an industry shakeout.

Robust Operating Momentum & Asset Utilization

EVgo’s operational momentum reflects a maturing infrastructure business with a focus on scaling throughput per stall while managing costs. In Q2 2025, public network throughput rose 35% year-over-year to 88 GWh, with throughput per stall reaching 281 kWh/day—up 22% YoY and 6% sequentially. July numbers suggest even stronger performance, with average throughput approaching 300 kWh/day. This uplift followed remediation of firmware issues and proactive maintenance on legacy hardware, which temporarily suppressed Q2 performance but has since rebounded. Additionally, EVgo is seeing benefits from growing usage among Tesla drivers following the introduction of NACS cables at pilot sites, with 30 more sites planned in Q3 and 100 retrofits by year-end. The expansion of high-power 350kW chargers to 57% of the network (up from 41% YoY) and higher Autocharge+ adoption (28% of sessions) are also boosting performance. Importantly, EVgo expects charge rates to increase further as EV models evolve, reducing the utilization needed to hit revenue targets. Management projects annual stall-level revenue of $90K–$104K and cash flow of $38K–$47K by 2029. Over half of Q2 throughput came from high-frequency users like rideshare, AV hubs, and OEM charging credit partnerships, providing recurring volume. Even accounting for slightly lower productivity on grant-funded stalls, higher offsets improve capital efficiency and IRRs. Altogether, EVgo’s utilization trajectory—combined with AI-enhanced pricing, targeted marketing, and site selection algorithms—supports a flywheel effect of better performance, more funding access, and faster network expansion.

Superior Business Model Vs. Peers

Unlike many fast-charging competitors, EVgo is both an operator and owner of its charging assets, allowing it to capture ongoing cash flows and build long-term operating leverage. The company now projects building up to 5,000 new stalls in 2029—more than double previous estimates and a sixfold increase from 2025 levels. This acceleration stems from declining CapEx per stall, more effective use of public-private incentives, and improved project execution timelines. EVgo’s gross CapEx per stall is expected to decline by 8% even with tariffs, while total net CapEx per stall for 2025 is projected at just $74K. These cost reductions are driven by standardized six-to-eight-stall sites, prefabricated skids, and negotiated vendor pricing. The top 15% of EVgo’s stalls already generate $50K in cash annually, demonstrating the operating leverage inherent in its asset base. Furthermore, EVgo’s commercial bank financing validates its project-level creditworthiness and introduces a second tier of institutional lenders beyond the DOE. This puts the firm in a structurally stronger position than peers reliant on equity or who lease rather than own infrastructure. EVgo’s integration with autonomous vehicle fleets via its hubs business (110 dedicated AV stalls as of 2024) also provides early exposure to high-frequency charging demand that competitors may miss. Ancillary revenues—largely from these hubs—more than doubled YoY and are expected to remain lumpy but material. Unlike peers navigating profitability via network fees or software licensing, EVgo is building a scaled, cash-generative infrastructure backbone with flexibility across customer types, site configurations, and funding sources.

Policy & Demand-Side Risk Could Pressure Metrics

Despite the strong positioning, EVgo faces mounting policy and macroeconomic risks that could compress margins or stall growth. The federal 30C tax credit, which currently offsets a portion of CapEx, is set to expire in June 2026. Although management expects $17 million in proceeds from its second 30C sale in 2024 and believes many assets will still qualify through mid-2026, the absence of long-term federal support could raise net CapEx per stall in 2027 and beyond. While state-level grants and utility incentives remain available, they vary regionally and often apply to less productive sites—impacting throughput per stall. Additionally, electric vehicle penetration, while growing, faces its own demand constraints. OEMs like Ford and GM have adjusted their EV production targets amid tepid consumer uptake of certain models. EVgo’s projections rely on strong adoption of higher-charge-rate vehicles and consistent public charging usage, particularly among rideshare drivers and urban dwellers without home charging. However, if EV volumes or utilization trends fall short, the unit economics could compress despite fixed-cost leverage. Furthermore, while EVgo touts flexibility in CapEx pacing, network build-outs still take 12–18 months, creating lag between capital deployment and cash flow generation. Seasonal electricity rate increases (e.g., summer utility tariffs) also impact margins and introduce volatility. Lastly, any underperformance in newer areas like NACS cable retrofits or AV charging hubs could dilute the anticipated uplift. While EVgo has prudently diversified its funding base and optimized cost structures, execution risks remain—particularly as macro support for EVs becomes more fragmented and competitive dynamics intensify.

Final Thoughts

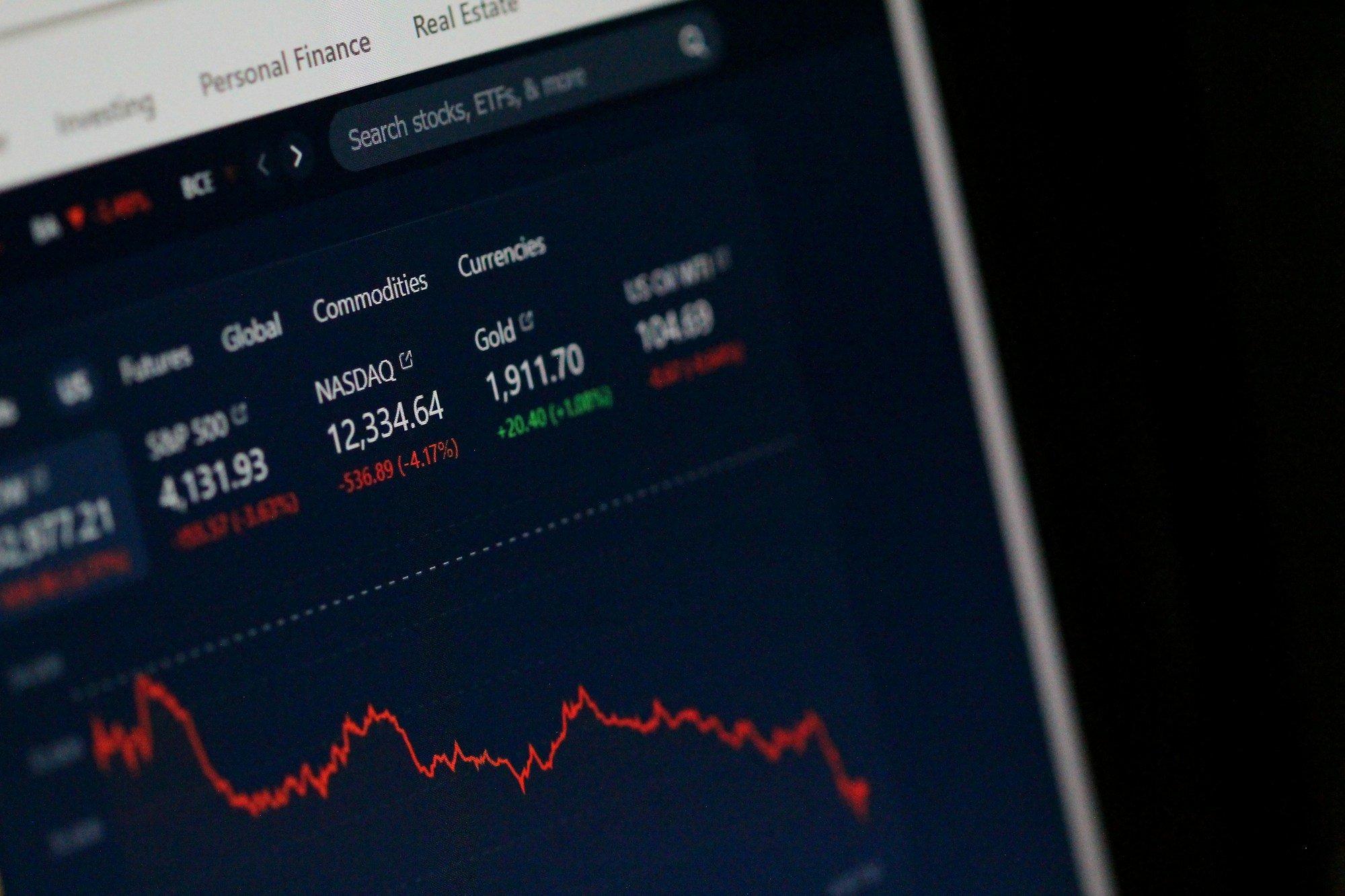

Source: Yahoo Finance

EVgo’s stock price has been climbing ever since the management has signalled its openness to acquisitions implying that the market does see a good chance of value creation through an acquisition-focused growth strategy. From a valuation perspective, EVgo trades at 4.16x LTM EV/revenue and 11.73x EV/gross profit as of September 2025—elevated compared to infrastructure peers given its negative LTM EBITDA of (22.11x) and limited cash flow visibility. Forward metrics like EV/EBITDA (69.42x NTM) and P/S (1.51x NTM) suggest that investors are pricing in significant margin expansion and capital discipline. The current move by the management signals a calculated response to shifting industry fundamentals as tax credit expiration looms and competitive attrition accelerates. To conclude, we believe that as consolidation looms, investors and industry stakeholders will be watching how EVgo balances ambition with pragmatism.