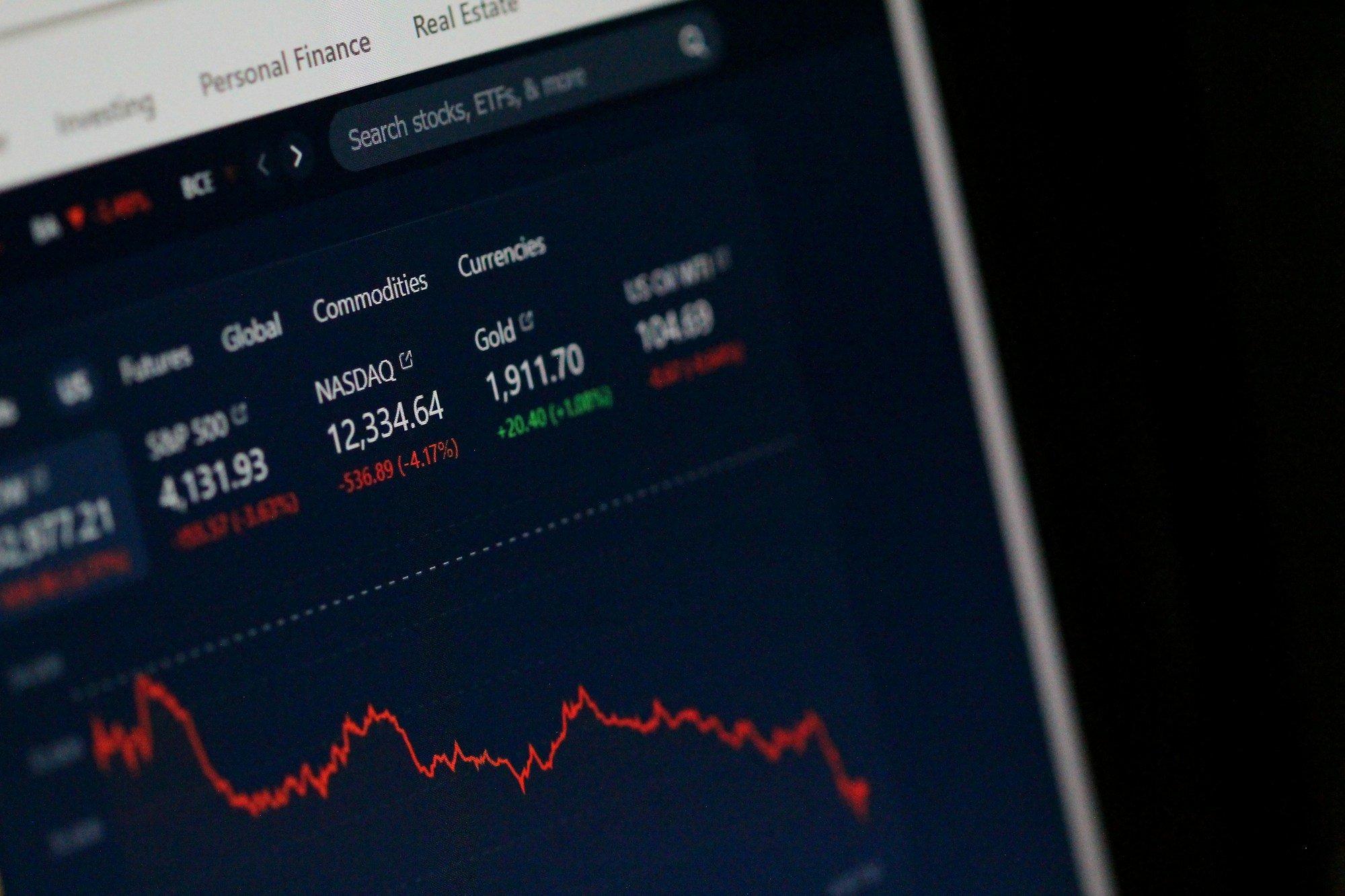

Gold futures experienced a massive surge on Friday, with the precious metal hitting record highs on the heels of tariff confusion surrounding Swiss gold imports. Gold hit $4,490 per ounce on the Comex exchange in New York as traders reacted to the announcement that Swiss one-kilogram and 100-ounce gold bars would be subject to a 39% reciprocal tariff under new trade policies from the Trump administration. The impact of this news shook global markets, with gold prices surging and inventories rising, as traders scrambled to adjust their positions.

Tariff Confusion Fuels Gold’s Record Highs

The introduction of tariffs on Swiss gold bars is a major disruptor in the market, particularly since these bars form a large portion of the trading activity in the U.S. Ryan McIntyre, senior managing partner at Sprott, explained that contracts on the Comex exchange, which require physical delivery, heavily rely on Swiss bars. As tariffs threaten to inflate costs and complicate the logistics of gold transfers, the market faces large uncertainty.

Reports from Customs and Border Patrol clarified that the tariffs would apply to the specified gold bars, but questions still linger about whether this marks a permanent policy shift or a potential error. Nevertheless, the confusion surrounding tariff implementation contributed to a significant surge in gold prices, with many traders bracing for further market fluctuations.

Global Gold Market Dynamics

Despite the tariff chaos, the global gold market has stayed strong. Gold is considered one of the most liquid assets globally, and experts suggest that the market will adjust to the new tariff environment by rerouting gold flows to minimize disruptions. Gold inventories in New York have already skyrocketed earlier this year as institutional investors moved elevated amounts of physical gold to secure vaults, anticipating the tariffs.

This shift in gold flows, although short-term disruptive, underscores the market's capacity to absorb shocks and adjust. According to Bloomberg data, gold inventories in New York hit their highest levels since the pandemic’s peak in 2021. The influx of physical gold into U.S. vaults earlier this year shows the market’s anticipation of such disruptions and its efforts to mitigate risks by stockpiling assets before the tariffs came into effect.

Looking Ahead

As the tariff uncertainty surrounding Swiss gold continues, traders will be closely watching the situation for further developments. The steep tariffs could lead to further disruptions in the global gold trade, impacting both prices and inventory flows. However, given the liquid nature of the gold market, it is likely that alternative sources and supply chains will emerge, helping to stabilize the market in the medium term. The broader implications of these tariffs on the gold market could also depend on whether other countries and trading partners are affected by similar tariffs or if these moves are isolated to Swiss imports. As the situation evolves, gold’s role as a hedge against economic uncertainty may increase, particularly if other markets, such as equities, face further volatility.

In the coming weeks, analysts and traders will continue to weigh the impact of these tariffs on gold prices and consider how institutional investors might adjust their strategies. For now, the surge in gold prices stands as a reminder of how quickly markets can react to geopolitical and trade-related developments.