Intel Corporation (NASDAQ:INTC), once the crown jewel of the semiconductor industry, is now grappling with severe challenges that threaten its future. As the company heads into a crucial board meeting scheduled for mid-September 2024, investors and stakeholders are anxiously awaiting the strategies that Intel’s leadership will propose to navigate these turbulent waters. The company, under CEO Pat Gelsinger, has been struggling to keep up with its competitors and is now reportedly considering drastic measures, including the possible divestiture of key business segments like Altera, its programmable chips unit, and even its foundry business. This potential sell-off of critical assets is a sign of Intel’s desperation to stabilize its finances and regain its footing in a rapidly evolving market. Moreover, the recent exodus of key executives has further shaken confidence in the company’s leadership and its ability to execute a turnaround. With its market capitalization plummeting and continuous quarterly losses, Intel is at a crossroads where every decision could have far-reaching consequences.

Divestiture of Altera: A Desperate Move to Shore Up Finances

Intel's consideration of selling its Altera division, a unit it acquired for $16.7 billion in 2015, is a clear indication of the financial distress the company is facing. Altera, which specializes in programmable chips, was once seen as a strategic asset that would help Intel diversify its product offerings and strengthen its position in the rapidly growing market for customizable semiconductors. However, the company's inability to fully capitalize on this acquisition, coupled with mounting financial pressures, has led to the decision to potentially divest this unit. The move to spin off or sell Altera reflects Intel's need to generate immediate cash to support its core operations and fund its ambitious, yet costly, research and development initiatives. This divestiture is a stark contrast to Intel's original strategy of integrating Altera's technology into its broader product portfolio to drive growth in emerging markets such as AI and data centers. The sale of Altera would not only signal a retreat from these markets but also highlight the company's struggle to manage its diverse business lines effectively. Furthermore, this potential sale raises questions about Intel's long-term strategy and its ability to compete with more focused and agile competitors who are rapidly gaining market share. In an industry where scale and integration are critical for success, the divestiture of Altera could weaken Intel's competitive position and limit its ability to innovate in key growth areas. As Intel continues to lose ground to rivals like Nvidia and AMD, the sale of Altera may provide short-term financial relief but could have detrimental long-term consequences for the company's ability to compete in the next wave of technological advancements.

Foundry Business in Jeopardy: A Blow to Intel's Manufacturing Ambitions

Intel's foundry business, which was once touted as a cornerstone of its IDM 2.0 strategy, is now reportedly on the chopping block. The foundry division was supposed to help Intel regain its manufacturing leadership by producing chips not only for its own needs but also for external customers. However, the foundry business has been plagued by delays, technical issues, and a lack of significant customer wins, which have cast doubt on its viability as a profitable venture. The potential sale or restructuring of the foundry division is a stark acknowledgment of these failures and the immense challenges Intel faces in its bid to compete with industry leaders like TSMC. The foundry business was expected to be a key driver of Intel's growth, particularly in the AI and high-performance computing markets, where demand for advanced semiconductor manufacturing capabilities is soaring. However, Intel's inability to execute on its manufacturing roadmap, combined with significant capital expenditures that have strained its finances, has made the foundry business more of a liability than an asset. The decision to possibly divest or scale back this division underscores the challenges Intel faces in balancing its ambitions with the harsh realities of the market. The foundry business was seen as a way for Intel to leverage its expertise in chip design and manufacturing to capture a larger share of the semiconductor market. Yet, the continuous setbacks and lack of clear progress have eroded investor confidence and put Intel's entire IDM 2.0 strategy at risk. The mid-September board meeting will likely determine the future of this division, but the fact that it is even being considered for divestiture highlights the precarious position Intel finds itself in. If Intel does decide to exit or significantly scale back its foundry operations, it would not only be a major strategic retreat but also a blow to the company's long-term aspirations of becoming a leader in semiconductor manufacturing.

Key Executive Exits Signal Deepening Crisis

The departure of a high-ranking executive like chip industry veteran Lip-Bu Tan has sent shockwaves through Intel, raising serious concerns about the stability and future direction of the company. This is not just a blow to Intel's leadership team but also a reflection of the internal turmoil that has been brewing within the organization. The loss of an experienced leader like Lip-Bu Tan who resigned from the board after a long period of debate over Intel’s future has created a vacuum of deep semiconductor business experience on the board as per a Reuters article. This is a critical setback, especially at a time when the company is already struggling to maintain its competitive edge in the semiconductor market. As Intel prepares for its mid-September board meeting, the absence of Lip-Bu Tan could leave the company vulnerable to strategic missteps. With the semiconductor industry undergoing rapid changes, driven by advancements in AI, cloud computing, and edge technologies, Intel needs strong, visionary leadership to steer the company through these challenges.

Final Thoughts: Intel at a Crossroads—Is the Turnaround Possible?

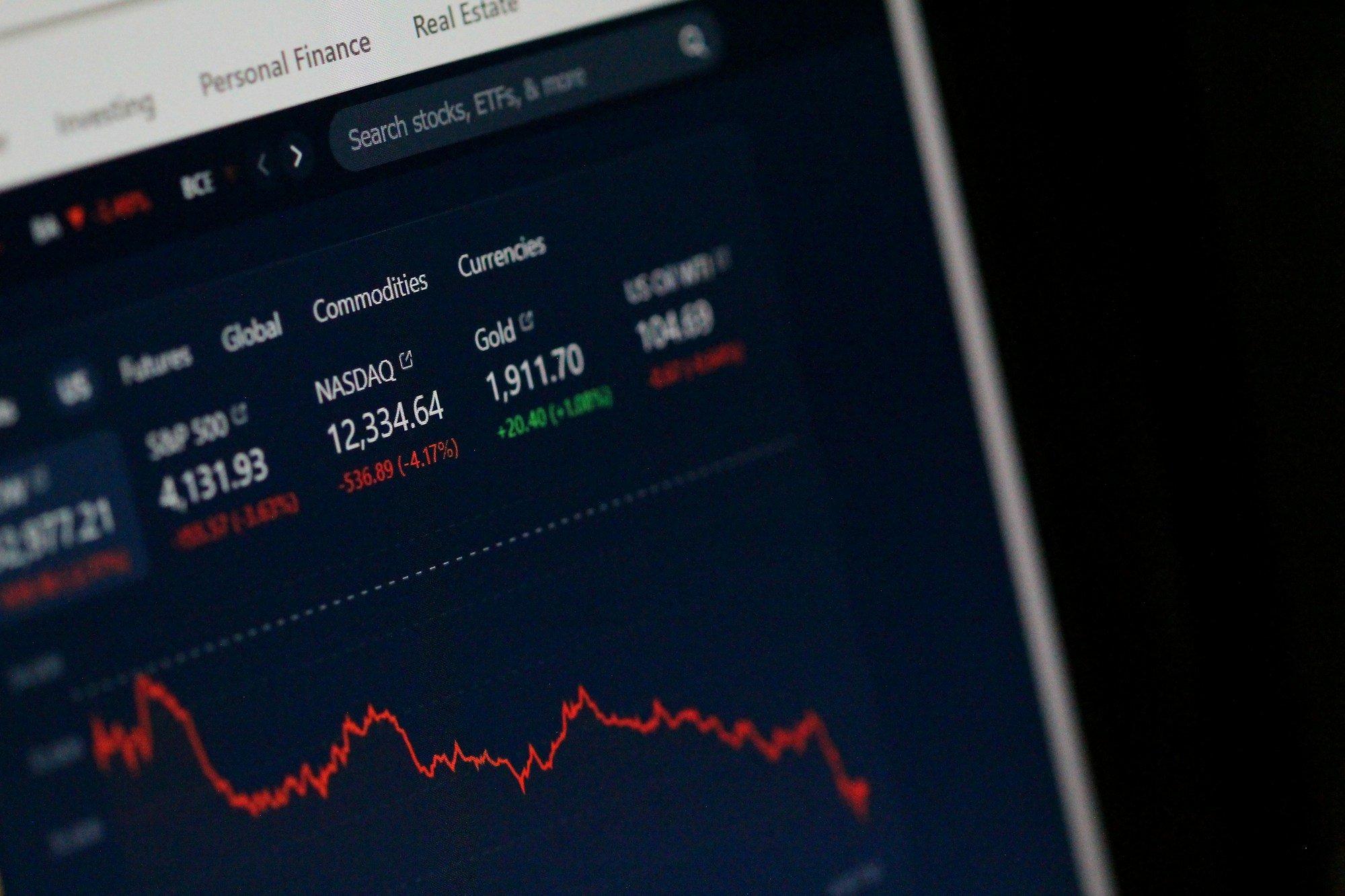

Source: Yahoo Finance

Intel's current situation is one of the most precarious in its storied history and this is evident from the way its stock price has crashed over the past 6 months. The company is facing multiple challenges, from leadership instability and potential divestitures to significant operational and financial hurdles. As Intel approaches its mid-September board meeting, the decisions made by its leadership will be critical in determining the company's future. While the company's turnaround strategy may offer some hope, the road ahead is fraught with uncertainty. As it stands, the odds appear stacked against Intel, and only time will tell if the company can reclaim its former glory or if it will continue to decline in the face of overwhelming adversity. Overall, we believe that given the current level of uncertainty, Intel’s stock is best avoided at current levels.