Motorola Solutions (NYSE:MSI) is making one of its boldest moves in recent years with the $4.4 billion acquisition of Los Angeles-based Silvus Technologies, a defense-focused radio communications company specializing in mobile ad-hoc networks (MANET). The deal, expected to close in Q3 or Q4 2025 pending regulatory approval, includes an additional earnout potential of up to $600 million based on Silvus’ performance through 2027 and 2028. This acquisition represents a notable pivot from Motorola’s traditional strength in mission-critical voice systems to high-bandwidth, software-defined networking for autonomous systems, military communications, border security, and public safety. Silvus, a portfolio company of TJC, has grown rapidly from just over $100 million in revenue in 2022 to an expected $475 million in 2025, with adjusted EBITDA margins of approximately 45%. The integration will allow Motorola to enter fast-growing defense and unmanned systems verticals while potentially leveraging its global distribution and lobbying influence to expand Silvus' customer base.

Expansion Into High-Bandwidth, Infrastructure-Free Communication

Motorola’s acquisition of Silvus marks a strategic extension into a new class of communication technologies that operate without the need for fixed infrastructure. Silvus’ MANET (mobile ad-hoc network) systems are designed to support seamless, decentralized, high-bandwidth communication in challenging environments, making them ideal for modern warfare, law enforcement, disaster recovery, and public safety applications. Unlike Motorola’s traditional land mobile radio (LMR) systems which focus on mission-critical voice, Silvus’ offering enables secure data, video, and audio transmission across self-healing mesh networks that adapt in real time. These networks support over 500 nodes without significant bandwidth degradation and are optimized to resist jamming, detection, and interception. The acquisition allows Motorola to bridge a capability gap in its portfolio by moving beyond narrowband voice into high-throughput, video-centric data streams—an area growing in importance due to the rise of drones, autonomous ground systems, and smart surveillance infrastructure. Silvus’ platform has already been field-tested in high-conflict zones like Ukraine and is currently being used across U.S. and allied military applications, suggesting operational maturity. The inclusion of Silvus’ software-defined capabilities also aligns with Motorola’s emphasis on digital security and resilient communications. Importantly, Motorola plans to retain Silvus as a standalone entity reporting directly to its COO, indicating that it sees the company’s culture and product direction as complementary rather than redundant. By investing further in R&D and go-to-market functions, Motorola believes it can scale Silvus’ reach and technological depth globally without disrupting existing public safety operations.

Entry Into Autonomous & Unmanned Systems Markets

The acquisition gives Motorola strategic access to one of the fastest-growing verticals in the defense and public safety landscape: unmanned systems. Silvus’ technology is already integrated with leading drone OEMs and supports key Department of Defense programs including Replicator and Collaborative Combat Aircraft (CCA). Its MANET radios offer critical command and control links as well as real-time video and data transfer capabilities required for modern swarm drone operations. With the proliferation of unmanned aerial, ground, and naval systems in both military and civil applications, secure and scalable communication has become a foundational requirement. Silvus’ software-defined, interference-resilient architecture meets this demand by enabling mesh networks that can function without GPS or traditional communication infrastructure. Motorola executives highlighted that Silvus’ ability to scale across 550+ nodes and maintain high data throughput in congested, jam-prone environments gives it a technological edge over other players like TrellisWare and Persistent Systems. The company also expects the total addressable market for unmanned systems communications to grow from a couple of billion dollars today to several billion over the next few years. Motorola’s intention to retain Silvus’ brand and management team suggests a hands-off approach that will allow Silvus to continue innovating at startup speed while tapping into Motorola’s lobbying capabilities, defense procurement access, and broader international presence. This synergy may help Silvus gain additional traction in homeland security, firefighting, and border control applications where secure drone communications are becoming critical.

Attractive Financial Profile & Scalable Growth Model

Silvus is expected to generate $475 million in revenue in 2025 with an EBITDA margin of approximately 45%, reflecting both strong top-line expansion and robust operational efficiency. This projection represents a compound annual growth rate well in excess of 50% from revenue estimates of around $100 million in 2022, driven in part by intense deployments in conflict zones like Ukraine. While Motorola anticipates 20% year-over-year growth from 2024 to 2025, executives acknowledged that the extraordinary growth seen during the height of the Ukraine conflict may not be entirely replicable. Nonetheless, Silvus’ current growth profile outpaces Motorola’s traditional businesses and offers a high-margin revenue stream that is expected to be accretive to non-GAAP EPS within the first 12 months of the acquisition. Importantly, this deal is not being justified based on cost synergies. Instead, Motorola is prioritizing revenue acceleration through increased investment in Silvus’ R&D and sales infrastructure. Motorola plans to finance the $4.4 billion upfront cost using a mix of long-term debt, short-term notes, and cash on hand, increasing its leverage by less than one turn on an adjusted EBITDA basis. An additional $600 million in earnouts is contingent on performance in 2027 and 2028. This earnout structure indicates Motorola’s confidence in Silvus’ future pipeline and incentivizes continued outperformance by its existing team. Overall, the transaction brings a combination of recurring defense business, scalable software-driven revenue, and high margins into Motorola’s financial mix, improving both its growth trajectory and profit quality in a challenging macro environment.

Strategic Alignment With Defense, Law Enforcement & Homeland Security Priorities

Silvus’ technology aligns with emerging national security needs, including battlefield communications, domestic surveillance, and rapid-response disaster recovery. Its adoption by U.S. and allied militaries for decentralized control of drones and sensor networks positions it at the center of future defense strategies. Beyond combat, Silvus’ radios are used by firefighters for aerial mapping during wildfires, law enforcement to create “tactical bubbles” for video surveillance at major public events, and homeland security to connect sensors along borders with command centers. Motorola’s CEO Greg Brown emphasized that Silvus fits into the company’s safety and security ecosystem without overlapping with its existing LMR voice products. Moreover, the company’s strong relationships with government agencies, its lobbying capabilities, and international regulatory familiarity are expected to help Silvus expand into additional programs at the Department of Homeland Security, NATO allies, and emerging markets. Motorola executives also believe that Silvus’ software-centric model, which relies on off-the-shelf rather than custom hardware, enhances its compatibility with evolving procurement standards that favor modular, rapidly deployable technologies. Furthermore, the company expects future demand for MANET-enabled unmanned systems to benefit from legislative developments that increase defense and homeland security spending. Motorola’s decision to keep Silvus as an independent unit, backed by its capital and brand, indicates a deliberate strategy to grow this niche without diluting the specialized value Silvus brings.

Final Thoughts

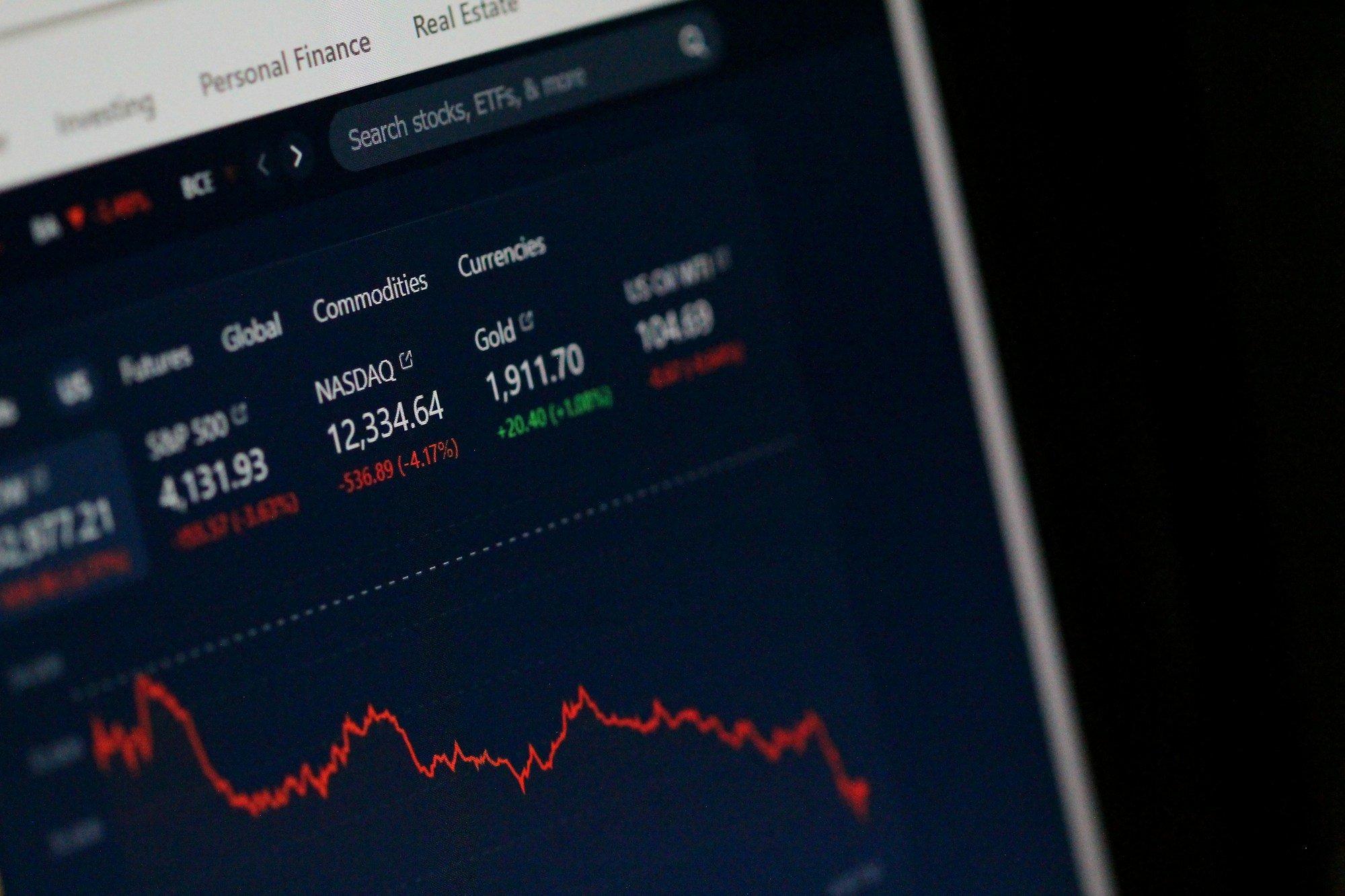

Source: Yahoo Finance

Motorola’s stock has seen a volatile downward trend over the past 6 months but one of the biggest reasons for this is its already expensive valuation. The company is currently trading at a staggering LTM EV/ Revenue multiple of 6.89x and a P/E of 35.46x which is extremely expensive. While the high valuation may not make Motorola a ‘Buy’ at current levels, investors must keep an eye on its acquisition of Silvus Technologies as a calculated move into software-defined, high-bandwidth, mission-critical communications designed for the next generation of defense and public safety needs. The deal offers Motorola access to high-growth markets such as autonomous systems, tactical surveillance, and decentralized battlefield networks, while strengthening its position in law enforcement and homeland security. It is to be seen how Motorola’s management deals with the integration risks, regulatory approvals, and the possibility of decelerating growth from past conflict-driven deployment peaks while integrating Silvus in the coming months.