The ODP Corporation (NASDAQ:ODP) has recently found itself back in the spotlight, rising 2.1% on news that it is exploring a potential sale. According to a Dealreporter item dated July 29, 2025, ODP has engaged JPMorgan to assist with the sale process and has begun soliciting preliminary bids. Private equity firms appear particularly interested in the wholesale segment of the business and are evaluating various structuring options, including retaining or splitting the retail and B2B divisions. This development comes as ODP continues to reshape itself through aggressive cost-cutting, a pivot to B2B distribution, and an expansion into adjacent sectors such as hospitality. Amidst all these developments the biggest question remains what drove ODP’s management to the sale exploration and what potential acquirers may find attractive in the ODP opportunity? Let us find out!

Operational Streamlining Through Optimize for Growth

ODP’s transformation under its “Optimize for Growth” initiative has redefined its cost structure and operational footprint, creating a more efficient and scalable business. As of Q1 2025, the company had shuttered 46 stores year-over-year, including 12 in the latest quarter alone, while reducing corporate overhead and simplifying its organizational model. The result has been a significant improvement in profitability metrics, with adjusted EBITDA hitting $76 million and adjusted free cash flow surging to $45 million in the quarter—more than double the prior year. These efforts have enabled ODP to reallocate capital to its core B2B operations, invest in digital capabilities, and reduce dependency on the volatile retail segment. By cutting back on physical retail exposure and eliminating high-cost infrastructure, ODP has set up a leaner business model that is more predictable and cash generative. For private equity firms, this streamlining represents low-hanging fruit that has already been partially realized, offering a de-risked path to sustained cash flows. The program’s ongoing benefits, including an improved cash conversion cycle and reduced capital expenditures ($21 million versus $31 million YoY), could make the business an attractive LBO candidate. Moreover, with a flexible cost base and decentralized support model, ODP is well-positioned for bolt-on acquisitions or additional carve-outs, enabling multiple paths to value creation. This level of operational cleanup prior to a sale gives buyers a clearer path to ROI and limits integration risk post-transaction.

Growing B2B Pipeline With High-Value Contracts

The core of ODP’s strategic pivot centers on its B2B platform, ODP Business Solutions, which is being repositioned as a growth engine targeting enterprise clients. While revenue in this segment declined 8% year-over-year to $852 million in Q1 2025, the underlying customer pipeline tells a more compelling story. Over the last three quarters, ODP has secured over $500 million in annualized spend across new contracts, including a marquee deal with CoreTrust—a collective with over 3,500 enterprise members across multiple sectors. However, most of these contracts are still in the onboarding phase and have yet to contribute meaningfully to revenue or margins. This presents a built-in growth driver that has not yet been capitalized in public valuations. The B2B unit is also expanding its addressable market through its entrance into the hospitality vertical, securing agreements with major hotel management groups and suppliers such as Sobel Westex and Hunter Amenities. Initial penetration covers up to 15,000 potential locations, with further partnerships under negotiation. These developments not only provide revenue diversification away from office supplies but also increase cross-sell opportunities and deepen customer entrenchment. Importantly, management has indicated that the second half of 2025 will see a ramp-up in contribution from these contracts, which adds short-term visibility for buyers. For strategic acquirers or PE firms with B2B expertise, the ability to accelerate onboarding, optimize pricing, and consolidate account management presents an immediate opportunity for margin expansion and revenue capture. The B2B segment, while not yet at its peak, offers a strong forward-looking catalyst.

Emerging Logistics Arm Provides Unlockable Asset Value

Veyer, ODP’s supply chain and logistics division, has evolved into a compelling standalone asset. Originally built to serve ODP’s internal retail and B2B units, Veyer has since expanded into third-party logistics, generating $17 million in external revenue in Q1 2025—an 89% year-over-year increase. The company has begun onboarding a slate of new third-party clients, which is expected to drive continued momentum in the second half of the year. While EBITDA from these customers was flat at $3 million, this result was affected by onboarding costs and infrastructure ramp. Still, the opportunity for scale is clear, especially given that much of Veyer’s fixed asset base is already in place. The division’s ability to provide procurement, warehousing, and last-mile distribution across North America allows for further expansion without significant incremental investment. For potential acquirers, particularly private equity firms, Veyer presents multiple monetization options. It could be spun off as a standalone logistics platform, integrated into a larger distribution network, or scaled through acquisitions of smaller 3PL providers. The logistics sector continues to command premium valuation multiples, and Veyer could unlock significant value relative to ODP’s current blended multiples. The division also complements the company's expansion into the hospitality supply chain, providing a back-end enabler for large-scale B2B deliveries. The dual role of cost center and revenue generator enhances Veyer’s strategic appeal and positions it as a key growth lever post-acquisition. Overall, the under-the-radar performance of Veyer makes it a high-potential asset that has yet to be fully recognized by public markets.

Final Thoughts

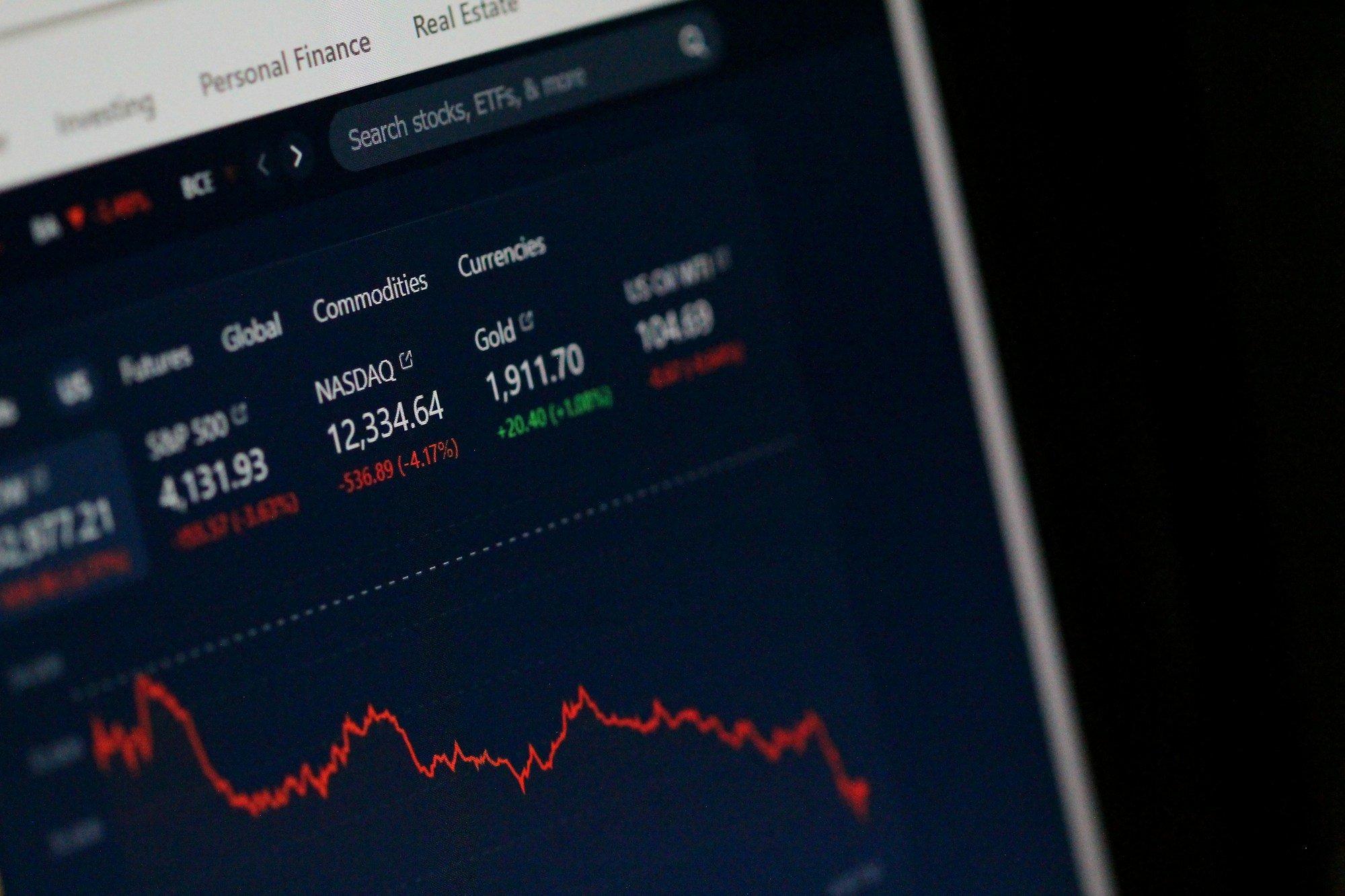

Source: Yahoo Finance

ODP’s decision to explore a sale has not resulted in any significant movement in the company’s stock price. From a valuation standpoint, the company’s LTM EV/Revenue sits at just 0.20x, while its LTM EV/EBITDA is a modest 5.32x. On a forward basis, these multiples compress further, with NTM EV/Revenue at 0.21x and NTM EV/EBITDA at 5.60x. ODP’s Price/Sales multiple remains just 0.08x, and its free cash flow yield is robust at 16.6%, reflecting the cash-generative nature of its operating model. These valuations are well below industry averages for both office supply and logistics peers, indicating significant room for multiple expansion if execution continues. Moreover, the company maintains a clean balance sheet with $653 million in liquidity against $262 million in debt, giving an acquirer the ability to finance a transaction using moderate leverage without overwhelming risk.

With a normalized P/E of just 6.57x and a stable dividend yield of 2.7%, ODP presents one of the rare instances where low valuation aligns with operating momentum and latent growth drivers. Buyers can reasonably expect to acquire the company at a discount to intrinsic value, while retaining upside through improved B2B performance, logistics monetization, or potential asset divestitures. Overall, we believe that ODP’s current market value reflects neither its strategic repositioning nor its cash-generating profile, making it a textbook target for a value-accretive acquisition.