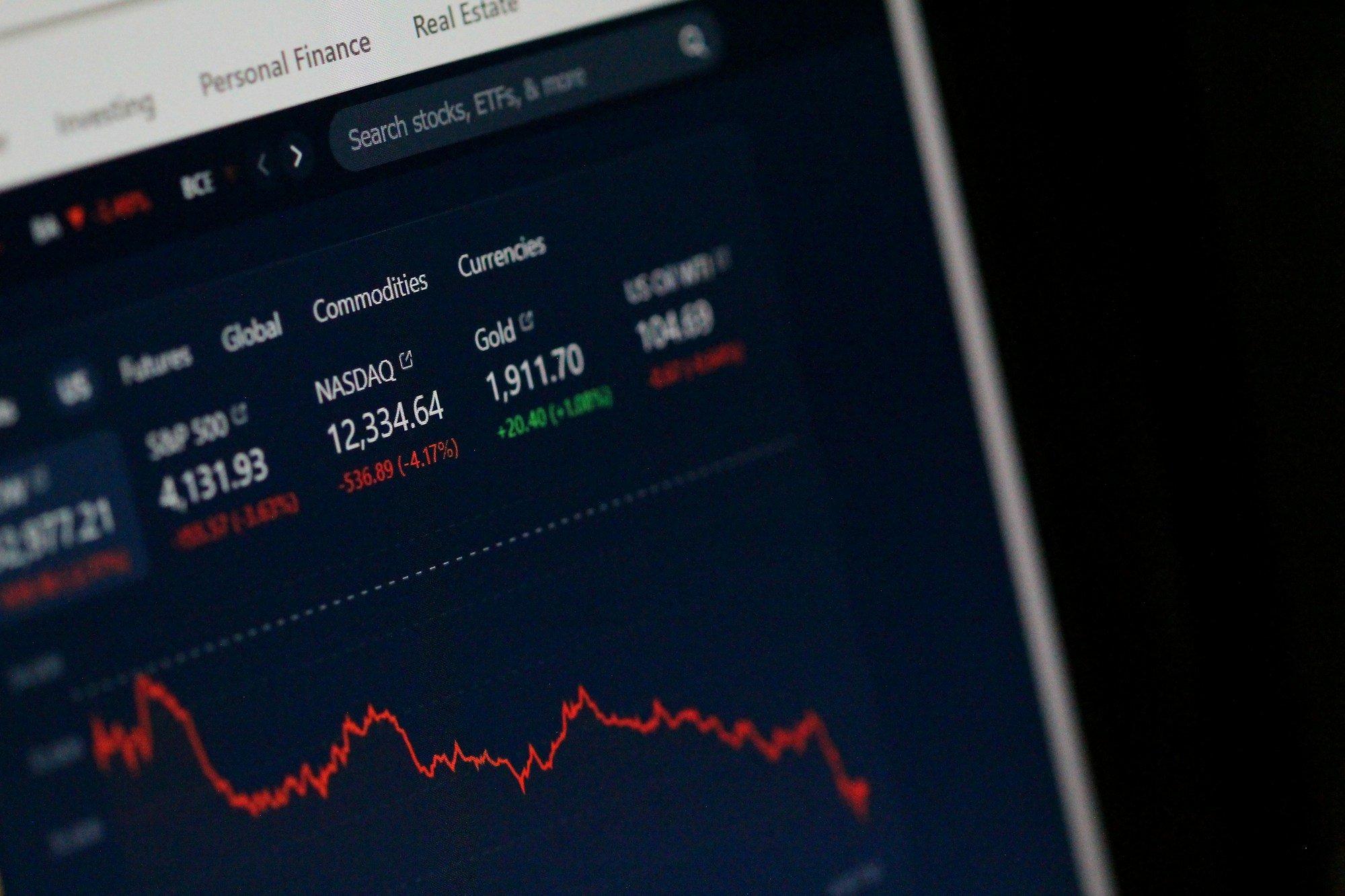

U.S. stocks took a big dip on Monday, with the Nasdaq Composite (IXIC) leading the decline, down 3.2%, as investor confidence in U.S. AI leadership fell. The S&P 500 (GSPC) dropped 1.8%, while the Dow Jones Industrial Average (DJI) hovered near the flatline, buoyed by gains in non-tech sectors.

The sell-off was set off by reports from Chinese startup DeepSeek, which claimed its AI model operates with far fewer resources yet matches the performance of leading U.S. systems. This revelation raised questions about future profitability for U.S. companies heavily invested in AI infrastructure, including Nvidia (NVDA), which plummeted 17%, and other tech giants like Microsoft (MSFT) and Alphabet (GOOG, GOOGL).

Market Movers:

- Nvidia (NVDA): Shares plunged 17% after DeepSeek’s announcement raised concerns about the sustainability of Nvidia’s dominance in AI chips. Investors are reevaluating Nvidia’s growth projections, especially as its chips power most AI systems in the U.S.

- Microsoft (MSFT): The tech giant's stock slide over 2% reflects broader concerns about megacap investments in AI. Microsoft has invested heavily in OpenAI and faces increased scrutiny of the returns of such commitments.

- Constellation Energy (CEG): Shares tumbled nearly 19% as AI-related power stocks, critical for fueling data centers, faced a wave of sell-offs. This followed a surge in demand earlier this year tied to AI optimism.

DeepSeek Shakes AI Leadership Confidence

The emergence of DeepSeek has caused significant market turbulence, challenging the dominance of U.S. firms in AI innovation. The Chinese company claims its latest model achieved breakthrough efficiency with dramatically lower costs, starkly contrasting U.S.-based OpenAI’s $100+ million investment in training its GPT models.

DeepSeek’s rapid rise has led to speculation about whether U.S. companies can maintain their competitive edge. While some analysts, like Stacy Rasgon from Bernstein, downplayed the immediate threat, the market reaction suggests investors are bracing for a potential shift in the AI landscape.

Trade War Threats Resurface

Trade tensions added to market unease after President Donald Trump threatened to impose 25% tariffs on Colombian goods during a diplomatic dispute. Though a resolution was reached, the swift escalation highlighted Trump’s willingness to use tariffs as a policy tool, reviving fears of broader trade conflicts.

The dispute comes as investors prepare for potential tariff measures against larger trade partners, including Mexico and China. Such moves could exacerbate inflationary pressures and complicate the Federal Reserve’s monetary policy decisions as officials gather for their first meeting of 2025 this week.

Economic Data Paints a Mixed Picture

Economic data offered a mixed outlook, adding to the day’s volatility. Sales of new homes rose 3.6% in December, beating expectations, but elevated mortgage rates and high prices continue to weigh on affordability. Meanwhile, consumer sentiment dipped, reflecting inflation concerns tied to potential tariff policies.

Looking Ahead

The fallout from DeepSeek’s announcement and Trump’s trade maneuvers sets the stage for a high-stakes week. With Big Tech earnings on the horizon, including results from Apple (AAPL) and Microsoft, investors will be waiting to see how companies plan to navigate these challenges.

The Federal Reserve’s upcoming policy meeting could also shift market dynamics as officials weigh the potential economic impact of Trump’s trade policies. While AI optimism has driven recent market gains, Monday’s sell-off underscores how fragile sentiment can be in a rapidly evolving landscape.