US stocks soared higher on Monday, signaling a rebound at the start of the Thanksgiving holiday week, the Fed leaned toward potential rate cuts, and Big Tech staged an impressive comeback. Investors returned to tech leaders after weeks of volatility, reigniting the AI trade that has dominated markets for most of the year.

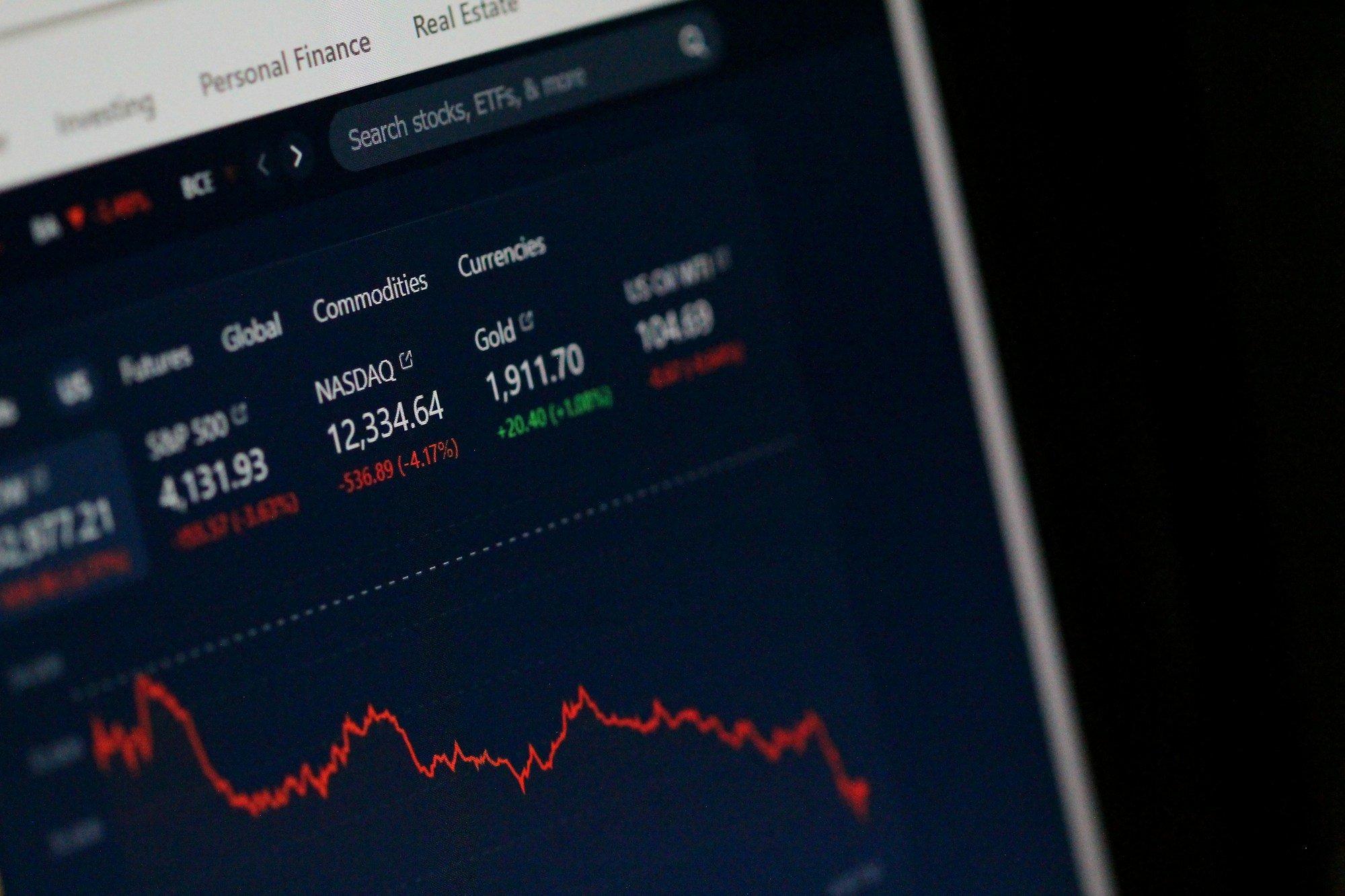

The Nasdaq Composite surged more than 2%, while the S&P 500 rose over 1.3%, extending Friday’s late-session bounce. The Dow Jones Industrial Average lagged with a 0.4% gain, weighed down by its limited tech exposure, yet still benefited from strong sentiment across growth stocks. The rally arrives as traders attempt to put recent turbulence behind them and reset expectations heading into December.

Market Movers:

- Nvidia (NVDA) +1.6%: Nvidia gained after reports that the US administration is considering whether to allow exports of its more powerful H200 chips to China. Investors took the move as a sign that Nvidia could expand its international AI footprint after restrictions curbed its China business this year.

- Alphabet (GOOGL) +5.8%: Alphabet surged past record highs as analysts responded positively to the launch of its Gemini 3 AI model, calling it a meaningful step ahead of rival platforms. A new multimillion-dollar cloud deal with NATO added fuel to expectations for enterprise AI adoption.

- Tesla (TSLA) +7.1%: Tesla jumped after an upgrade from Melius Research declared the automaker a “must own” stock due to advancing full self-driving capabilities. A social media post from Elon Musk revealing progress on Tesla’s next-generation AI chips further boosted enthusiasm.

- Bitcoin (BTC-USD) – modest recovery near $87,000: Bitcoin’s rebound steadied after a weekend sell-off that briefly dragged the token below $81,000. Traders noted that crypto remains volatile despite broader risk appetite improving in equities, highlighting ongoing tension in speculative assets.

Fed Signals Fuel Rate-Cut Optimism

Momentum accelerated after Federal Reserve officials Christopher Waller and John Williams hinted that a December rate cut remains possible. Their remarks helped reset expectations after a month of uncertainty caused by delayed economic data during the government shutdown. Options pricing moved in favor of potential easing next month, though traders remain split about how aggressive policy will be into 2026.

A series of postponed reports will arrive this week, including producer prices, retail sales, and a crucial reading on consumer confidence. Analysts say these data points could either cement the case for easing or push the Fed toward a slower path.

Global Trade Tensions

Markets also weighed growing geopolitical uncertainty as US and EU trade officials held their first major meeting since reaching a tariff deal in July. The Supreme Court is preparing to decide whether the administration’s earlier tariff orders were legally imposed, creating potential ripple effects in metals, autos, and tech supply chains.

The Commerce Department is reportedly crafting contingency plans if the ruling goes against the administration. While investors largely brushed off the issue on Monday, the debate underscores fragile trade relations heading into an election year.

Tech Earnings and AI Skepticism Shape Market Narrative

Earnings season winds down this week with Alibaba, Kohl’s, and Best Buy in focus, offering a test of consumer strength ahead of holiday spending. At the same time, influential investors are shaping the narrative around the AI boom. Michael Burry — famed for forecasting the 2008 housing crash — shuttered his hedge fund and launched a newsletter arguing that AI spending mirrors the dot-com bubble’s “manic investment boom.”

Yet Wall Street continues to reward near-term progress, particularly among companies demonstrating tangible revenue growth tied to AI. Monday’s market action suggests investors are still eager to chase upside — as long as fundamentals keep delivering.

Looking Ahead

The shortened holiday week now hinges on economic data and signals from policymakers. If rate-cut hopes continue firming and Big Tech maintains momentum, November’s sell-off may prove to have been a temporary reset rather than a turning point. But investors will be watching for cracks beneath the surface, including crypto volatility, trade uncertainty, and rising skepticism toward the AI buildout. For now, markets are betting that easing policy plus tech leadership could fuel a year-end rally. The question is whether the data arriving this week will confirm that optimism — or challenge it.