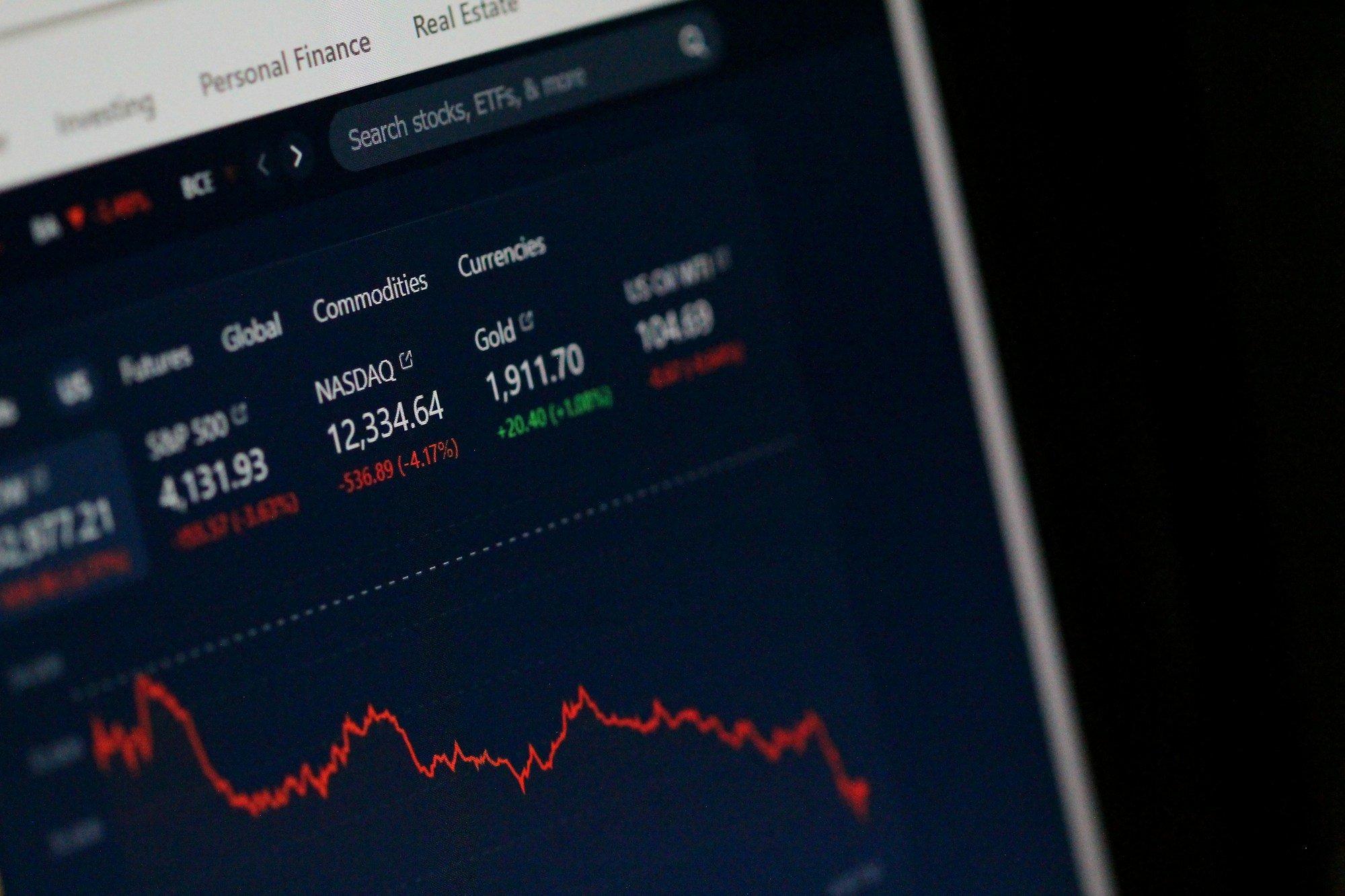

U.S. stocks bounced back on Friday as investors digested news regarding President Trump’s sweeping tariff policies and his nomination of Stephen Miran to the Federal Reserve Board of Governors. The Dow Jones Industrial Average (DJI) rose 0.5%, while the S&P 500 (GSPC) gained 0.8%. The tech-heavy Nasdaq Composite (IXIC) climbed 0.9%, pushing it to near-record levels for the second consecutive day. As tariffs began taking effect, Wall Street focused on the impact of the changes to the Federal Reserve, and the potential for more moves in the coming months.

Market Movers:

- Apple (AAPL): Apple shares surged by 4.4%, as news of a $100 billion U.S. investment commitment to manufacturing in Kentucky caught investors’ attention. The deal aims to avoid steep tariffs on Apple’s products, as CEO Tim Cook met with President Trump to announce the investment, helping the stock climb.

- Nvidia (NVDA): Nvidia rose by 0.7% on the back of President Trump’s suggestion that certain chipmakers could be exempt from upcoming tariffs. This potential carveout provided some relief for chip stocks, including Nvidia, which has significant exposure to the global semiconductor market.

- Toyota (TM): Toyota saw a 4.0% rise, even though its previous earnings reports showed that tariffs would impact its operating income by around $9.5 billion. The company’s stock benefited from broader market sentiment and global automotive sector trends, despite the pressure from rising duties.

- The Trade Desk (TTD): Shares of The Trade Desk plummeted nearly 40%, following a weaker-than-expected earnings report. The company cited the negative effects of tariff uncertainty on large global advertisers, which led to a significant slowdown in ad spending, directly impacting its growth.

Tariffs and Fed Nominations in Focus

A key driver for today’s market performance is the ongoing tariff implementation that President Trump set into motion on Thursday. With tariffs ranging from 10% to 50% on goods from nearly 200 countries, investors are assessing the potential economic fallout. Gold prices surged to record highs, partially driven by concerns about the impact of the tariffs, particularly on imports from Switzerland.

In addition to the tariffs, President Trump’s nomination of Stephen Miran to the Federal Reserve Board of Governors has fueled further speculation about the future of monetary policy. The markets were already betting on a rate cut in September, and this nomination adds an extra layer of uncertainty, particularly with the speculation about who will be the next Federal Reserve chair. While Miran’s confirmation is still pending, his selection has drawn attention to the shifting power dynamics within the Fed.

Corporate Earnings and Trade Uncertainty

This week’s corporate earnings reports provided a mixed bag of results. Companies like Apple and Toyota have been relatively resilient, despite the looming tariff pressures. Apple’s commitment to U.S. manufacturing was seen as a strategic move to mitigate risks posed by global trade tensions. On the flip side, companies like The Trade Desk and Toyota are facing direct impacts from tariffs on imported goods, particularly affecting their bottom lines.

Earnings reports this week have focused on the balance between corporate growth and the macroeconomic environment. With the potential for tariffs to increase costs and disrupt supply chains, some companies have warned of future uncertainties, while others are managing to weather the storm with strategic moves, such as increased domestic production or adjusting pricing strategies.

Looking Ahead

As tariffs begin to take full effect, investors will be closely watching the broader impact on corporate earnings and inflation. The next major test for the market will come when earnings season continues to unfold in the coming weeks, with tech and consumer goods companies poised to report. The Fed’s stance on interest rates will also be pivotal in shaping market sentiment, with investors keenly focused on any signs of more aggressive rate cuts.

In the short term, the outlook for stocks will depend on how companies navigate tariff pressures and whether the Fed can strike the right balance between fostering economic growth and curbing inflation. With speculation about the next Fed chair continuing to build, the market could face increased volatility until a clearer picture emerges. For now, the markets remain cautiously optimistic, driven by strong earnings and strategic adaptations to global trade challenges.