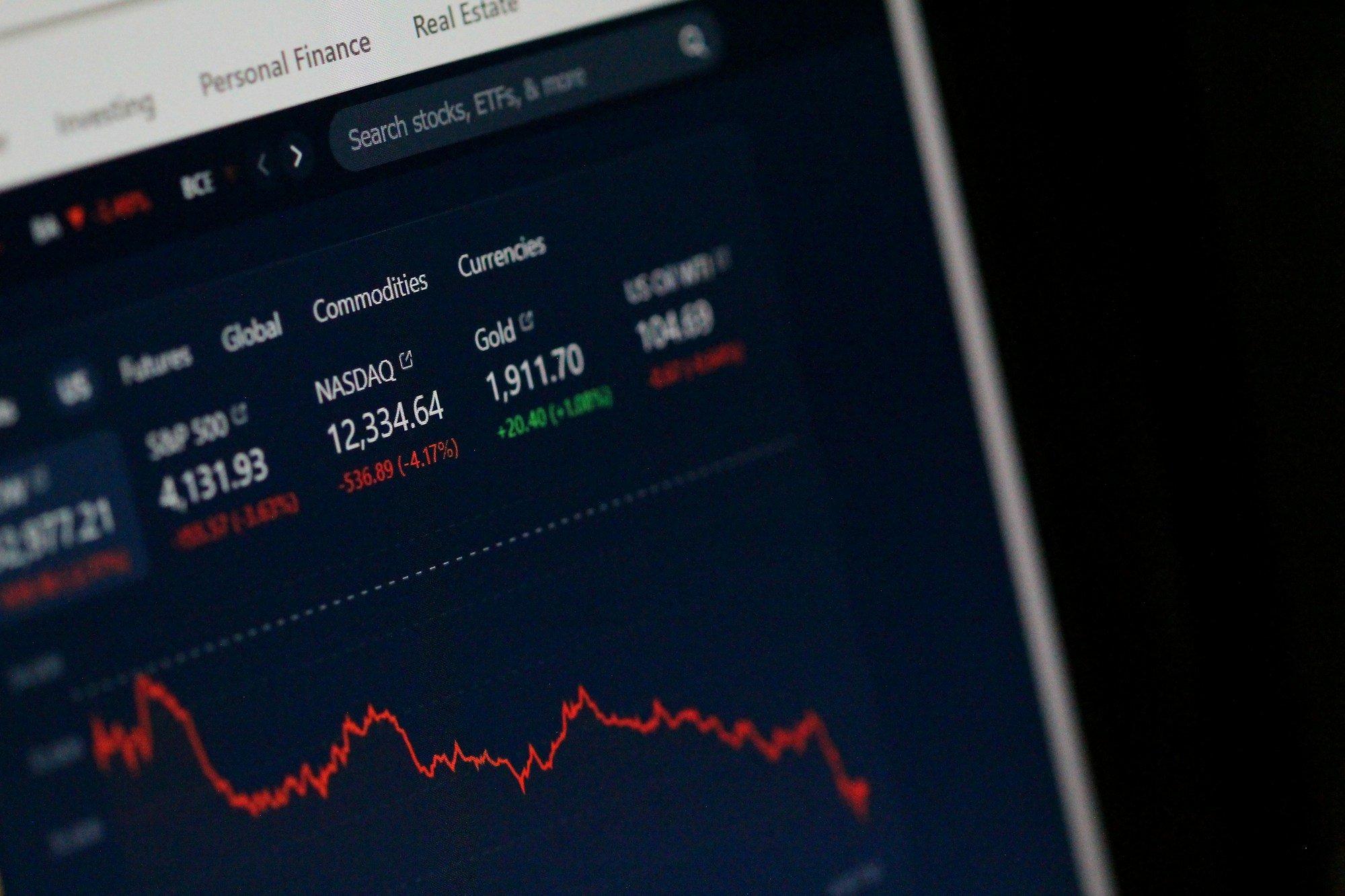

U.S. stocks struggled on Thursday as a hotter-than-expected Producer Price Index (PPI) report for July dampened expectations of a bigger Federal Reserve rate cut in September. The Dow Jones Industrial Average (DJI) fell 0.3%, while the S&P 500 ^GSPC) dropped 0.2%. The tech-heavy Nasdaq Composite (IXIC) remained near flat, reflecting mixed sentiment across sectors.

The PPI data showed month-over-month prices jumped 0.9%, significantly above the anticipated 0.2% increase. On a year-over-year basis, producer prices climbed 3.3%, marking the fastest pace since February. Core PPI, which excludes volatile food and energy costs, surged at its largest rate in three years, signaling underlying inflation pressures that could influence the Fed’s upcoming policy decisions.

Market Movers:

- Boeing Co. (BA): -2.1%: Shares slid as concerns about production delays and rising material costs came into focus. Analysts noted that while the company has delivered key aircraft models, higher expenses are pressuring margins. The stock’s decline reflects broader worries about industrial sector profitability amid inflationary headwinds. Boeing’s performance today underscores how rising input costs are affecting even well-established aerospace firms.

- Apple Inc. (AAPL): +0.3%: Apple had modest gains despite the overall market pullback. Optimism about resilient iPhone sales and ongoing growth in services revenue appears to have tempered investor caution. Analysts also highlighted the company’s strong balance sheet as a buffer against macroeconomic uncertainty. Apple’s performance demonstrates the market’s tendency to favor tech stalwarts even when broader indices retreat.

- Tesla, Inc. (TSLA): -1.5%: Tesla fell amid investor caution following the inflation shock. Concerns about potential rate hikes affecting consumer financing for EVs weighed on sentiment. Analysts continue to point to strong delivery numbers and international expansion as positives, but the near-term reaction illustrates the sensitivity of growth stocks to macroeconomic signals. Tesla’s stock movement highlights the fine balance between operational performance and market-wide economic fears.

- Microsoft Corp. (MSFT): +0.2%: Microsoft held steady as the tech giant’s diverse revenue streams continue to support its valuation. Investors are particularly focused on enterprise cloud growth, which has shown resilience despite the inflation report. Analysts suggest that Microsoft’s broad market exposure may insulate it against sector-specific volatility. The stock’s performance reflects cautious optimism in an otherwise jittery market.

Inflation Data Dampens Rate-Cut Optimism

The PPI report, which measures the cost of goods at the producer level, sent waves through markets that had been riding high on expectations for a September rate cut. Wall Street had rallied in recent sessions after July’s Consumer Price Index report suggested a moderation in inflation. However, the stronger-than-expected PPI reading raises questions about whether the Fed will scale back interest rates as aggressively as traders had anticipated.

Higher producer prices often translate to rising consumer costs, adding pressure on corporate margins and potentially slowing economic growth. Investors are now reassessing their portfolios in light of these inflationary pressures, with many reallocating toward sectors historically viewed as more resilient to rising costs, such as technology and consumer staples.

Bitcoin and Crypto Sentiment

Cryptocurrencies, which had benefited from bets on aggressive Fed rate cuts, also showed mixed activity. Bitcoin briefly reached new highs on Wednesday before retreating, reflecting heightened sensitivity to central bank signals. Market watchers note that a shift toward higher-than-expected inflation could temper crypto enthusiasm in the short term, though long-term adoption narratives remain intact. The digital asset market’s movement highlights the growing interplay between traditional macro indicators and crypto valuations.

Looking Ahead

Investors will turn their attention to upcoming economic data, including retail sales and employment reports, for clues on inflation trends and the Fed’s next moves. Market sentiment may remain volatile as traders weigh the balance between persistent inflation and the potential for looser monetary policy later this year. Strategic positioning in defensive sectors, coupled with selective exposure to growth stocks, is likely to define portfolio adjustments in the coming sessions.