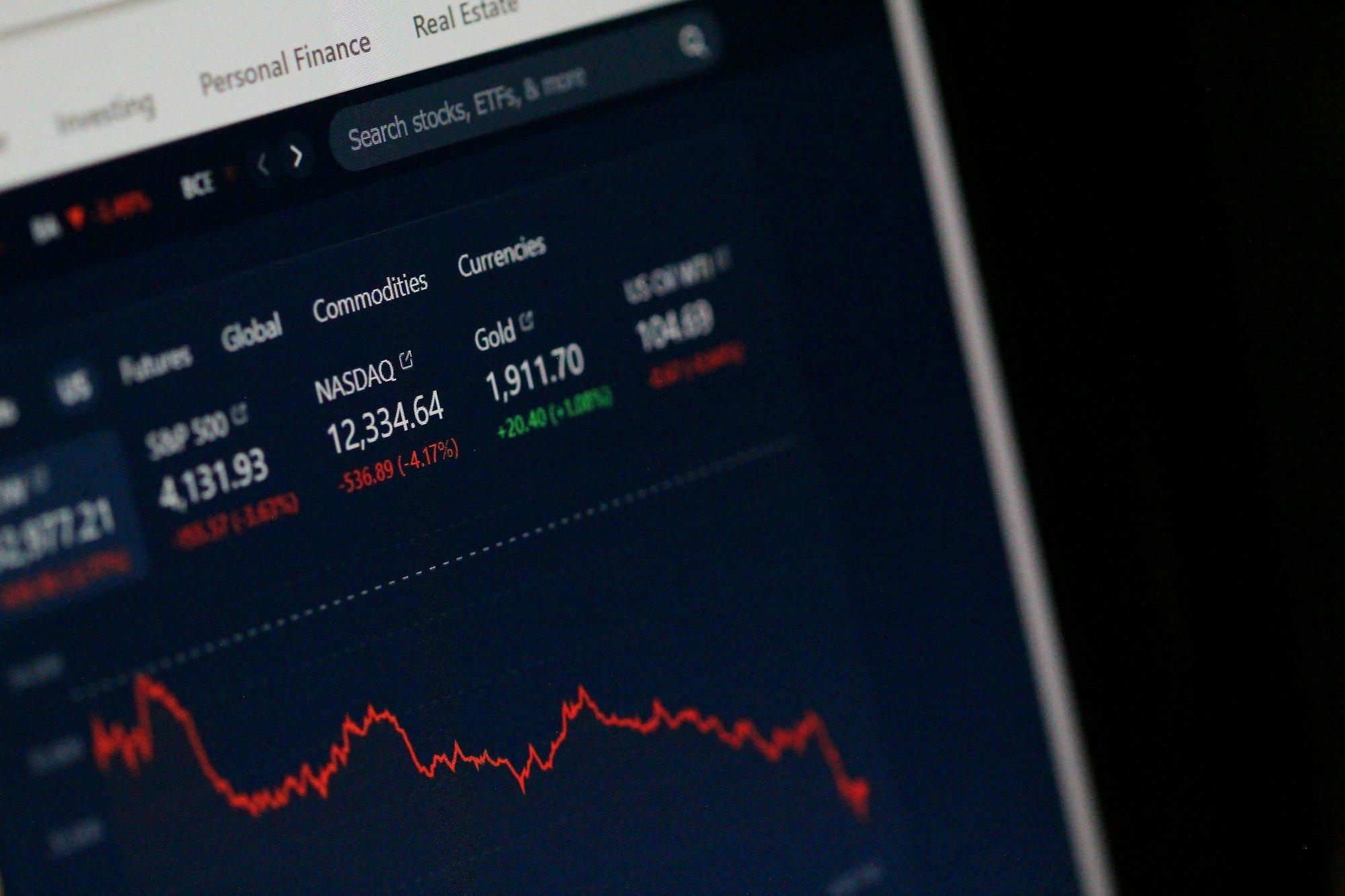

On Thursday, the stock market struggled for direction as new inflation data added uncertainty to the Federal Reserve's next policy move. The Dow Jones Industrial Average (DJI) hovered around the flatline, slipping 0.1% by midday, while the S&P 500 (GSPC) fell 0.2%. The Nasdaq Composite (IXIC) dropped 0.4%, retreating from its milestone close above 20,000 earlier this week.

The market’s attention was squarely on inflation figures and their implications for monetary policy. Meanwhile, Bitcoin (BTC-USD) surged past $101,000, strengthened by optimism surrounding crypto-friendly policies anticipated under the Trump administration.

Market Movers:

- Nvidia (NVDA): Shares of the chipmaker slid 2% on Thursday, leading the tech sector lower. The decline comes as Nvidia faces heightened regulatory scrutiny from China, which recently launched an antitrust inquiry into the company. Despite the setback, Nvidia remains committed to its regional AI initiatives, reportedly ramping up hiring for AI chip development aimed at autonomous vehicles.

- Adobe (ADBE): Adobe’s stock plunged nearly 13% following a weak revenue forecast for its 2025 fiscal year. The company cited slower-than-expected returns on its AI investments as a primary concern, dampening investor sentiment. This marks a stark contrast to its earlier gains driven by optimism around AI-related tools.

- Tesla (TSLA): Tesla reversed early losses to trade slightly higher, building on its record close from the previous session. The recovery comes amid continued enthusiasm for its expanding EV lineup and growing market share in key regions like Europe and China. Analysts remain bullish on Tesla’s ability to capitalize on the green energy transition.

Inflation Concerns Resurface

Fresh data from the Producer Price Index (PPI) revealed a 0.4% rise in wholesale prices for November, exceeding expectations of a 0.2% increase. The uptick has rekindled concerns about persistent inflation, even as consumer inflation appeared more subdued earlier in the week.

The hotter-than-expected PPI reading has investors questioning whether the Fed will proceed with a widely anticipated quarter-point rate cut at its December meeting. According to the CME FedWatch tool, the probability of a rate cut remains high at 99%, but January’s policy stance now appears less certain.

Global Central Banks in Focus

The Swiss National Bank made headlines with an unexpected 0.5% rate cut, its largest in nearly a decade. This move underscores growing economic concerns in Europe and sets the stage for the European Central Bank’s (ECB) policy decision later today. Economists predict the ECB will deliver its fourth rate cut of the year as the region grapples with sluggish growth.

Streaming Wars Intensify

In the streaming sector, YouTube TV (owned by Alphabet, GOOGL) announced a price hike to $82.99 per month, up from $72.99, citing rising content costs. Despite the increase, YouTube continues to dominate the streaming landscape, capturing 10.8% of total US TV viewing in November, per Nielsen data.

Other platforms, including Disney+ (DIS) and Peacock (CMCSA), have also raised subscription prices recently, reflecting a broader trend in the industry as providers balance growing content investments with profitability goals.

Looking Ahead

Investors remain focused on inflation data and its implications for monetary policy as the Fed’s December meeting approaches. With mixed signals from consumer and producer price data, market sentiment is likely to remain volatile in the days ahead. Meanwhile, global central bank actions and ongoing earnings updates will continue to shape the trading landscape.

While tech stocks face headwinds, sectors such as energy and financials could offer stability as investors weigh their options in an uncertain environment.