C3.ai (NYSE:AI), the enterprise AI software leader, has been at the center of attention on Reddit and other social platforms following its recent developments, which have sparked intense discussions about its future prospects. The announcement of deeper partnerships with tech giants like Microsoft and Google Cloud has propelled market enthusiasm, further cementing C3.ai's position in the AI landscape. With 224 active pilots—a 117% increase year-over-year—and significant traction in public sector solutions, the company is demonstrating its potential to scale. However, lingering questions about profitability and pilot conversions leave investors evaluating whether the company can deliver consistent value. Let us analyze the key factors that will determine if C3.ai can sustain its momentum.

Rapid Expansion In Public & Federal Sectors

C3.ai has rapidly penetrated the public sector, signing 25 agreements with state and local governments in Q1 FY25. This marks a 500% year-over-year growth in the segment, driven by innovative applications such as property appraisal and generative AI for public services. The company’s collaboration with Google Cloud played a pivotal role, with 40 agreements closed under their joint campaign, underscoring the strong demand for AI solutions in state and local government. Federal adoption is equally impressive, with over 30% of bookings in Q1 coming from agencies like the U.S. Navy, Air Force, and Marine Corps. These entities are leveraging C3.ai’s solutions for personnel management, legacy system modernization, and operational efficiency. The growing acceptance of C3.ai in government sectors showcases its ability to address large, underserved markets with high-value solutions. However, public sector adoption tends to involve complex sales cycles, which can delay revenue realization. While the rapid pilot-to-contract conversions seen in Q1 are encouraging, sustained performance will depend on maintaining high success rates and scaling these relationships across geographies.

Strengthened Partner Ecosystem

C3.ai’s partnerships with hyperscalers like Microsoft Azure, Google Cloud, and AWS are proving to be transformational. These alliances enable C3.ai to leverage cloud infrastructure while offering prebuilt AI applications tailored to industry-specific needs. The company reported a 94% year-over-year increase in partner-supported bookings, with 72% of total agreements now driven by its partner ecosystem. The strategic alignment with Microsoft, designating Azure as its preferred cloud platform, and Google Cloud’s support for public sector solutions highlight the mutual benefits of these collaborations. Hyperscalers gain from increased consumption of their compute and storage resources, while C3.ai benefits from extended market reach and accelerated deal closures. This ecosystem also underpins C3.ai’s ability to penetrate new markets like Europe, where public sector opportunities could double its addressable market. Yet, the competitive dynamics among cloud providers and reliance on these partnerships introduce a degree of risk. Any shifts in priorities or competing offerings from partners could impact C3.ai’s growth trajectory, making continued alignment essential.

Subscription Revenue Growth & Pilot Conversions

C3.ai’s subscription revenue—accounting for 84% of total revenue—grew 20% year-over-year in Q1 FY25, signaling strong demand for its SaaS-based enterprise AI solutions. The 224 active pilots and a projected 70% conversion rate are key to driving future growth. These pilots serve as a proving ground for C3.ai’s applications, enabling clients to assess ROI before committing to full-scale deployments. Success stories such as Holcim’s adoption of predictive maintenance applications demonstrate the value of C3.ai’s solutions in reducing operational disruptions and optimizing decision-making. However, the pilot-heavy model also creates near-term gross margin pressure, as pilots incur higher costs before transitioning to long-term contracts. Additionally, about 30% of pilots fail to convert, often due to internal client decisions rather than technical shortcomings. Ensuring a higher conversion rate and managing pilot costs will be critical to scaling revenues and achieving profitability. Investors will also closely watch subscription revenue growth and customer retention metrics to gauge the long-term sustainability of this model.

Final Thoughts

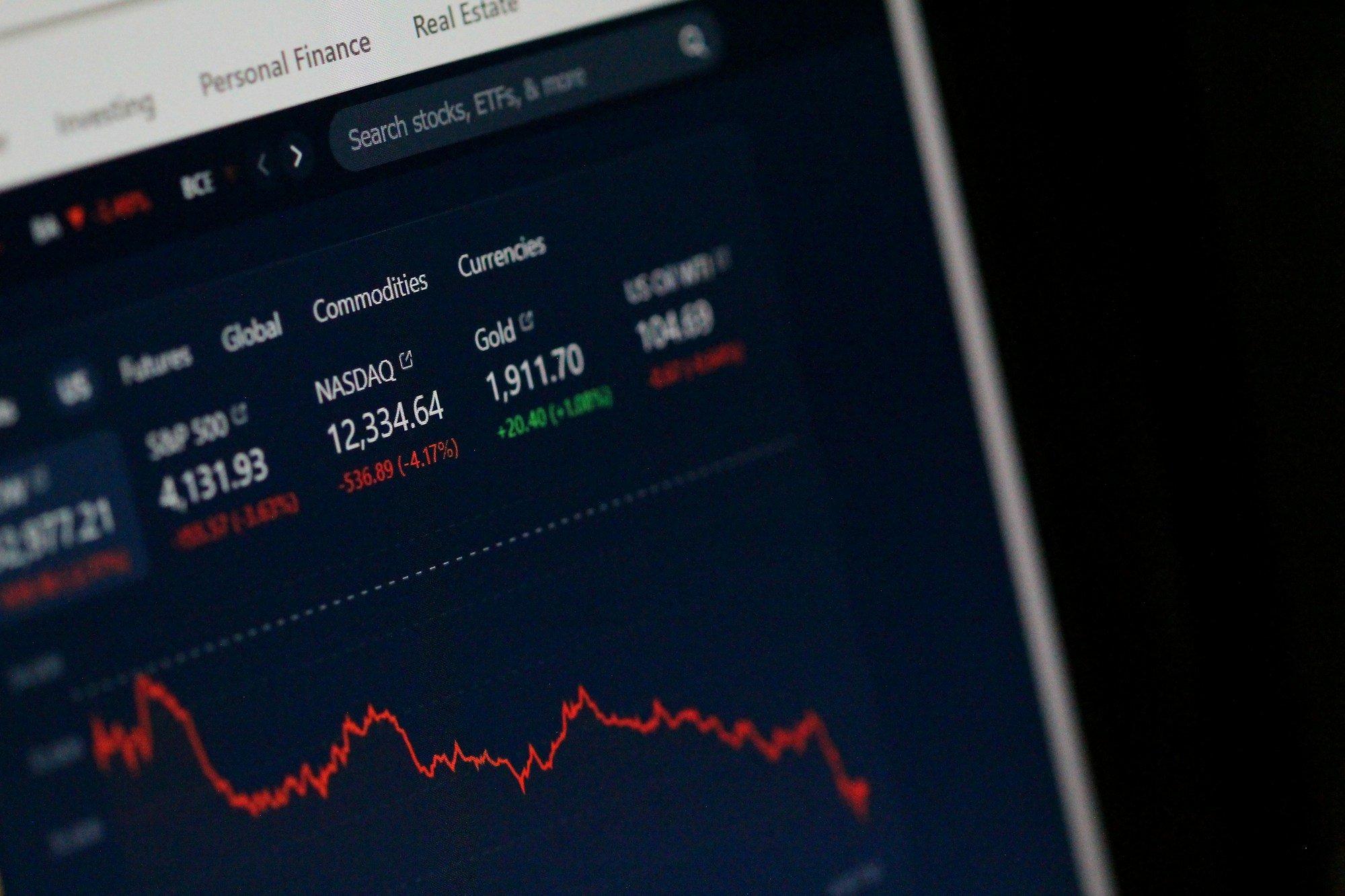

Source: Yahoo Finance

C3.ai’s stock has seen a highly volatile trajectory in 2024 as shown in the above chart. The company’s strategic moves—expanding its public sector footprint, deepening partnerships with hyperscalers, and growing subscription revenues—underline its potential to capitalize on the booming enterprise AI market. However, challenges like pilot conversion rates, ongoing losses, and competitive pressures remain areas of concern. As the company targets FY25 revenue growth of 19-27%, its ability to execute consistently across sectors will define its future trajectory. We strongly believe that investors should carefully weigh the company’s solid growth prospects against the inherent risks before making a decision of investing in the stock.