Integral Ad Science (NASDAQ:IAS), a leader in ad verification and media quality solutions, is now in the spotlight following takeover interest, making it a strong acquisition candidate for both strategic buyers and private equity players. With Jefferies Financial Group Inc. advising, IAS is exploring options in response to market interest. IAS's portfolio spans ad measurement, optimization, and publisher services, and its expansion into key international markets and new partnerships in the social media domain, positions IAS as a promising target. The company has strategically leveraged Oracle's exit from the ad verification market, acquiring new clients and talent to boost its capabilities. Let us take a closer look at the company and analyze the biggest drivers that make IAS a compelling acquisition target for both strategic and private equity investors.

Strong Market Position In Ad Verification & Measurement

IAS has established itself as a market leader in ad verification and measurement, which is increasingly critical as advertisers demand transparency and accountability in their digital ad spend. IAS’s Total Media Quality (TMQ) product suite offers advertisers detailed insights across social media platforms, including Meta, YouTube, and TikTok, providing a competitive edge over other industry players. The company has expanded partnerships with major platforms such as Pinterest, Reddit, and Snap, demonstrating its ability to stay relevant and meet evolving market needs. Furthermore, IAS's leadership in deepfake detection technology, launched ahead of high-profile global events like the Olympics and U.S. elections, showcases its commitment to innovation. IAS is also uniquely positioned within the connected TV (CTV) space, offering granular measurement solutions at both the content and channel levels. The strong growth in CTV and video metrics, driven by partnerships with major streaming services, aligns IAS with long-term ad market shifts toward streaming and digital-first media. This dominant position across a diversified portfolio makes IAS attractive to strategic buyers looking to reinforce their digital advertising offerings and private equity players seeking a company with established market leadership and high-growth potential.

Rapid International Expansion & Strong Client Retention

IAS’s international growth strategy has paid dividends, with 31% of revenue now generated outside the Americas, fueled by high adoption of its social media solutions and substantial gains in the EMEA and APAC regions. The recent global wins with telecommunications giants like Orange and Telefonica highlight IAS's strong competitive positioning and client trust in its technology. IAS has demonstrated resilience and appeal across multiple global markets, even as the ad industry faces challenges such as inflation and shifting privacy regulations. Notably, IAS’s customer retention metrics underscore the scalability of its offerings, with average annual spend increasing by 55% in the second year of new contracts since 2019. This trend is further supported by IAS's relationships with Fortune 500 clients and global brands like Stellantis and Perfetti Van Melle, which have renewed and expanded partnerships based on IAS’s advanced verification and measurement capabilities. By securing these multi-regional, high-value clients, IAS has proven its capacity for scalable international growth, an attractive quality for potential acquirers seeking to enhance global market reach.

Sustained Financial Performance & Predictable Revenue Streams

IAS’s consistent financial growth, particularly in revenue and adjusted EBITDA, provides both strategic and private equity acquirers with a reliable source of value. With a 14% revenue growth forecast for 2024 and a 34% adjusted EBITDA margin, IAS consistently outperforms financial targets, reflecting operational efficiency and effective cost management. The company’s net revenue retention (NRR) rate of 112% further highlights its robust revenue-generating model, as it successfully upsells and cross-sells to existing clients while attracting new customers. IAS’s strong foothold in the social media ad market, with social media representing 22% of its total revenue in Q2, underpins its stability and growth potential within the digital ad ecosystem. The company’s strategic focus on high-margin optimization and measurement products also positions it for margin expansion, making it particularly appealing to private equity buyers focused on revenue predictability and operational efficiency. Additionally, IAS has capitalized on Oracle’s exit from the ad verification market, winning RFPs and acquiring former Oracle employees to bolster its expertise. This agile approach to capturing new revenue opportunities and integrating acquired talent further reinforces IAS’s financial and operational strengths, making it an attractive acquisition for private equity and strategic acquirers alike.

Final Thoughts

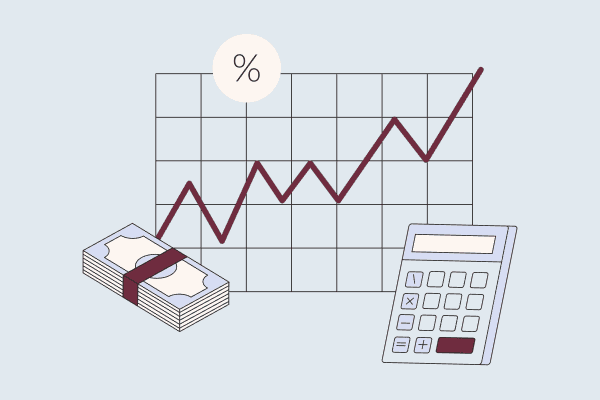

Source: Yahoo Finance

We can see how the news of Integral Ad Science exploring a potential sale has resulted in a notably uptick in its stock price. The company is currently valued at an LTM EV/ Revenue of 3.95x and an LTM EV/ EBIT of 44.84x which is on the higher side as compared to its peer group. There is little doubt that IAS has positioned itself as a leading player in ad verification and measurement, underpinned by strong international growth, robust financial performance, and innovative product offerings. Its growing relevance in the global ad tech landscape, with a diversified and reliable revenue model, positions it as a promising acquisition target. However, the high valuation indicates that there would be fewer price-sensitive acquirers that would be interested and also that there may not be a very high acquisition premium on the table for M&A investors. Hence, we believe that IAS’s stock is best avoided at current levels.

Responses (0 )