Apple Inc. (NASDAQ:AAPL) is facing one of the most multifaceted periods in its recent history, juggling rising tariff costs, legal crackdowns, geopolitical headwinds, and the shifting sands of consumer demand. Most notably, the company revealed it expects a $900 million hit to its cost of goods sold in the June quarter alone due to escalating tariffs, with analysts warning the figure could double in the coming quarters. Despite efforts to move production away from China to India and Vietnam, the global trade climate under the Trump administration continues to create uncertainty. Meanwhile, Apple’s legal entanglements with Epic Games and its attempts to defend a $20 billion search deal with Google are compounding investor concerns. Coupled with delays in delivering key AI features like the revamped Siri assistant and declining sales in critical markets like China, Apple is navigating a uniquely complex operating environment. Below are the five most pressing drivers affecting Apple right now.

Tariff Pressures & Supply Chain Overhaul

Apple disclosed in its latest earnings call that it anticipates a $900 million increase in cost of goods sold for the June quarter alone due to tariff-related impacts, largely driven by the Trump administration's trade policy targeting China. This hit is tied to Apple’s reliance on China-based manufacturing for products still subject to the 20% IEEPA-related tariff and a new 145% tariff on specific product categories like AppleCare and accessories. Analysts caution this $900 million may underrepresent future impacts, with projections suggesting costs could rise to $1.8 billion per quarter if tariffs persist or expand. In response, Apple is accelerating its production shift, stating that a majority of iPhones for the U.S. market will be sourced from India by the end of 2025, with other products such as iPads, Macs, Watches, and AirPods increasingly produced in Vietnam. Apple has also committed to sourcing more than 19 billion chips from the United States this year, supported by Taiwan Semiconductor Manufacturing Company’s new facility in Arizona. While this diversification mitigates some geopolitical exposure, CEO Tim Cook admitted that complete decoupling from China is not feasible in the near term, especially for complex manufacturing needs like future foldable iPhones. The strategic shift is aimed at creating supply chain resiliency, but these efforts entail substantial upfront costs and operational complexity, potentially placing pressure on near-term gross margins and adding layers of unpredictability to Apple’s cost structure going forward.

China Revenue Decline & Market Share Erosion

In the March quarter, Apple reported a 2.3% year-over-year decline in Greater China revenue, falling short of analyst expectations at $16 billion compared to the $16.83 billion consensus. Although adjusted for foreign exchange the decline was closer to flat, the trend marks Apple’s seventh consecutive quarter without revenue growth in China. This is particularly significant given China’s historic role as both a key growth market and production hub. The downturn is attributed to multiple factors, including growing competition from domestic smartphone players like Huawei, Xiaomi, and Oppo, as well as rising consumer nationalism and regulatory barriers. Notably, China has imposed restrictions on foreign-branded technology in government-related workplaces, directly impacting Apple’s institutional demand. The delayed rollout of Apple Intelligence in China has also made the iPhone less competitive in a market where rivals have introduced AI-rich and foldable smartphones. Cook acknowledged that although some subsidy programs may have helped stabilize results, high-end iPhones priced above RMB 6,000 are excluded from such benefits. Despite these challenges, Apple retains some foothold: iPhones were among the top two selling models in urban China, and new customer adoption for Mac, iPad, and Watch remains healthy. However, the overall trajectory signals headwinds in regaining significant share amid structural shifts in consumer preferences and competitive positioning. As Apple navigates regulatory complexities and operational transitions, China remains both a vital and vulnerable geography in its portfolio.

Legal & Regulatory Pressures On Services Business

Apple’s Services division, which includes the App Store, Apple Pay, and Apple TV+, hit a record $26.6 billion in revenue in the March quarter. However, this segment now faces multiple regulatory and legal threats that could materially impact its future profitability. Most prominently, Judge Yvonne Gonzalez Rogers recently ruled that Apple violated a 2021 injunction from its antitrust battle with Epic Games. The court found that Apple’s tactics to discourage alternative payment options—such as scare screens and a 27% commission on non-App Store transactions—were deliberate and potentially in contempt of court, prompting a DOJ referral. Apple responded by filing an emergency motion to stay the order, arguing that complying would cause “serious and irreparable harm” to its business. Meanwhile, in a separate antitrust case against Google, the Department of Justice is proposing a remedy that would prevent Google from paying Apple billions of dollars to remain the default search engine on Safari. Apple received $20 billion from Google for this purpose in 2022—equivalent to 18% of its pretax income. In its legal filing, Apple not only defended the payment but argued that search competition is intensifying with the rise of AI-based alternatives like ChatGPT and Perplexity. Apple even suggested that forcing Google to share its search index with AI rivals could be a more effective remedy. These legal outcomes are pending, but both cases underscore the increasing scrutiny Apple faces around its ecosystem control and its reliance on high-margin service revenues tied to dominant platform behavior.

Delays & Gaps In AI Strategy Execution

Apple’s efforts to integrate artificial intelligence across its ecosystem have met with mixed results and delays, especially compared to peers. While the company has introduced features such as Writing Tools, Genmoji, and Clean Up through its Apple Intelligence suite, a critical element—an upgraded, more personal Siri powered by generative AI—remains delayed. CEO Tim Cook admitted that while progress is ongoing, the Siri updates “need more time to meet our high-quality bar,” and there is currently no firm timeline for release. This comes at a time when rivals like Google, OpenAI, and Microsoft are rapidly enhancing their AI assistants and embedding them across consumer and enterprise platforms. Apple has built its own foundational models and developed a hybrid approach where some queries are processed on-device while others utilize a privacy-focused cloud layer called Private Cloud Compute. However, execution lags have raised concerns about whether Apple can maintain its ecosystem stickiness in a market increasingly influenced by AI-driven experiences. In markets where Apple Intelligence features have rolled out, the company did observe a stronger iPhone 16 performance, but this was limited to early Q2 geographies and may not reflect broader trends. Furthermore, delayed AI adoption in China due to regulatory constraints has compounded Apple’s difficulties in that market. As Apple moves toward a heavier reliance on its own silicon and edge AI inference models, investor attention will likely focus on whether the company can close the innovation gap with rivals and convert its AI investments into tangible differentiation.

Margins Under Pressure & Uncertain Outlook

Apple’s gross margin in the March quarter stood at 47.1%, but product gross margin declined to 35.9%, down 340 basis points sequentially. This margin compression was driven by a mix of factors including foreign exchange, seasonal product leverage loss, and upfront costs tied to supply chain restructuring. The June quarter guidance includes an expected margin range of 45.5% to 46.5%, already incorporating the estimated $900 million tariff-related cost impact. CFO Kevan Parekh noted that the cost to source from newer geographies like India and the U.S. is already partly embedded in margin expectations. However, future quarters could see more volatility depending on the outcome of Section 232 tariff investigations into semiconductors and related downstream products. Additionally, Apple’s capital return strategy—though robust with a new $100 billion buyback authorization—may be read by investors as a signal of limited growth opportunities in core business lines. Meanwhile, Apple has pledged $500 billion in U.S. investments over four years, covering chip procurement, server manufacturing, and data center expansions. These investments, while strategic for long-term resilience, are likely to pressure near-term capital efficiency. As Apple juggles these dynamics, maintaining margins and investor confidence without passing rising costs to consumers will be a significant challenge.

Final Thoughts

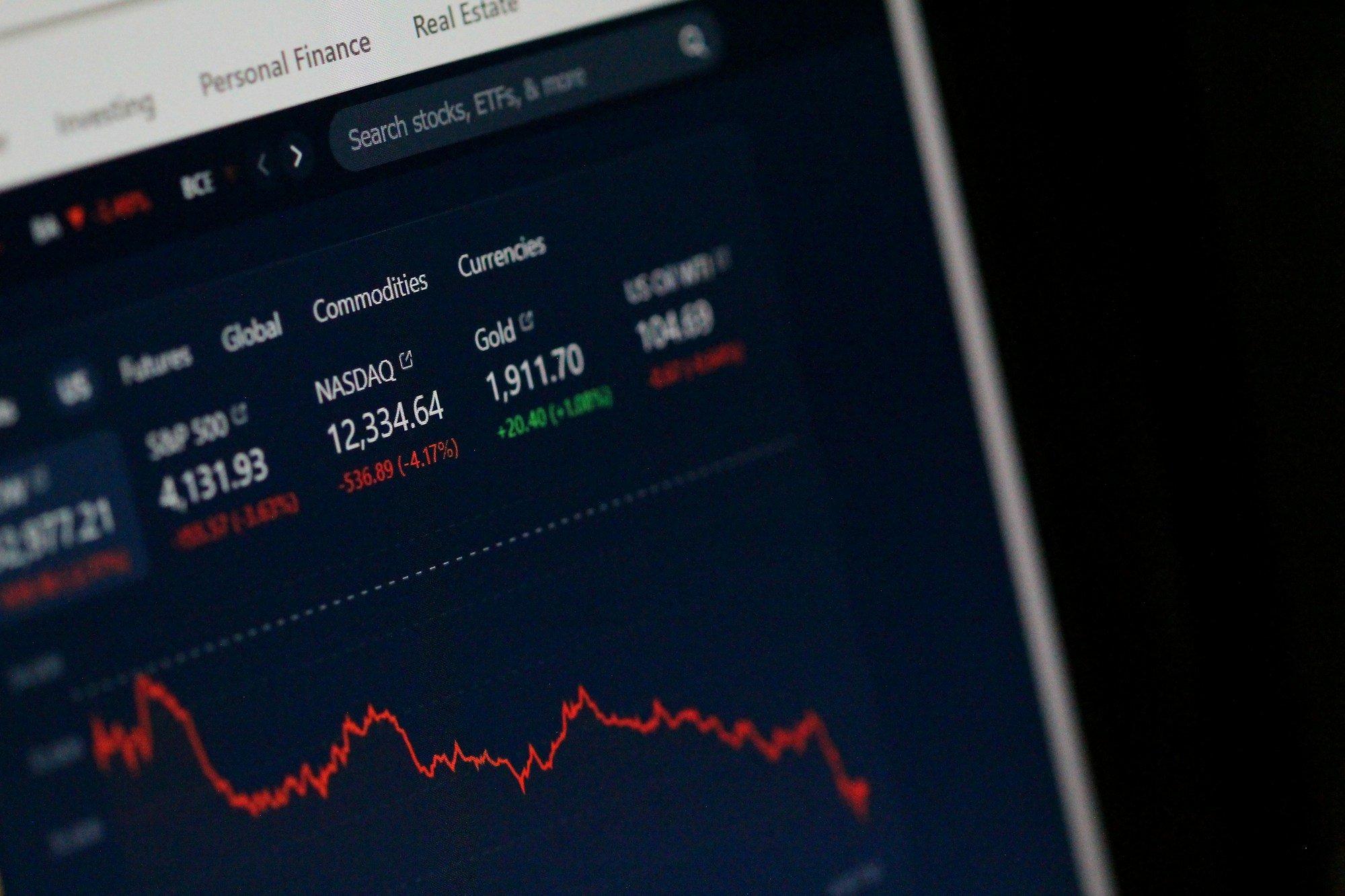

Source: Yahoo Finance

As we can see in the above chart, Apple’s stock has taken a beating along with broader markets after Trump initiated the tariff war. The dip in Apple’s stock can also be attributed to the fact that the company is currently navigating an unusual convergence of challenges—from escalating trade tariffs and supply chain shifts to legal scrutiny and delayed AI feature rollouts. The management’s proactive steps, including geographic diversification of manufacturing and a growing AI roadmap, show strategic foresight. Yet, these actions also introduce new risks and operational complexities. With regulatory pressure mounting on both its hardware ecosystem and high-margin Services business, and with uncertainty surrounding future tariff impacts, investors must closely evaluate both the structural strengths and emerging vulnerabilities in Apple’s model before carrying out any further investments in the stock.