Small-cap stocks are a unique opportunity within the diverse landscape of investment opportunities. With market capitalizations below $2 billion, they hold the promise of delivering impressive returns, alluring investors with the potential for substantial gains. However, this promise comes hand in hand with a journey through uncertain and often unpredictable terrain. In this article, we embark on an exploration of the risks and rewards associated with small-cap stocks.

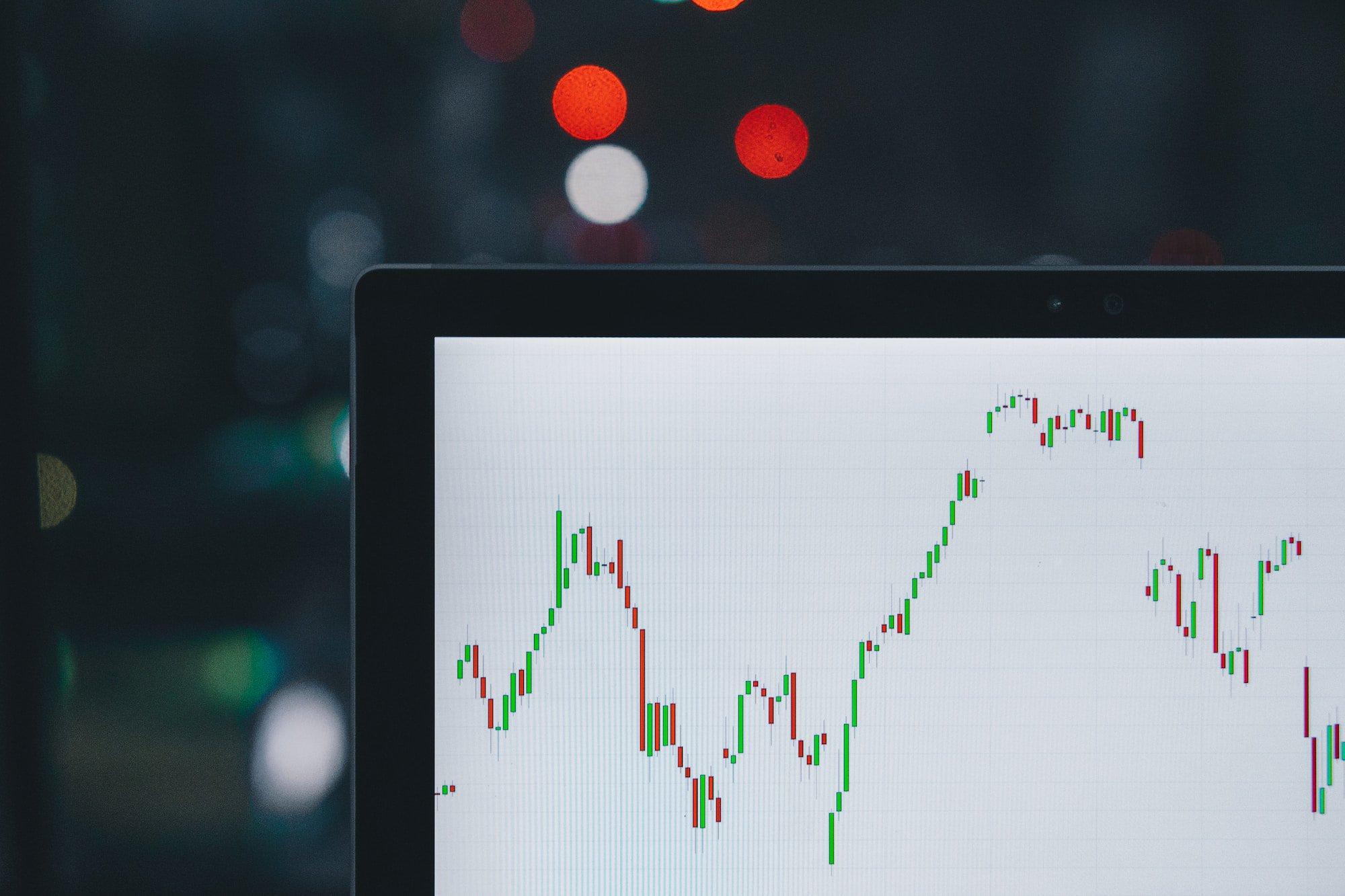

The Swinging Pendulum

Small-cap stocks get a lot of attention because they are more risky but can also give bigger rewards compared to larger players. The risk isn't only about how big the companies are, but it's about how they react to changes. Small-cap stocks move more quickly in response to changes in the market. Their value can go up and down a lot, which could mean you make more money, but it also means there's more risk for investors.

Low Liquidity Challenges

Small-cap stocks face a problem called "liquidity." This means they aren't traded as much as bigger stocks, so buying and selling them can be harder. This can cause issues for investors who want to quickly sell or buy stocks. It might stop them from getting out of a stock they want to leave or from getting into a good opportunity right away.

Growth on the Horizon

Amidst the turbulence, small-cap stocks hold a treasure trove of potential rewards. At the heart of their allure lies the promise of growth. These companies, often in their nascent stages, have a greater capacity for expansion compared to more established counterparts. They are the start-ups, the innovators, and the disruptors, primed to capitalize on untapped markets and transformative technologies.

The Unseen Value

Small-cap stocks can also be like hidden treasures. Sometimes, the market doesn't pay much attention to these companies or doesn't realize how valuable they are. This can be good for careful investors. If you buy small-cap stocks at a lower price than they're really worth, you might make a lot of money later on when the market realizes their true value.

Navigating the Ups and Downs

For those considering small-cap stocks, it's important to keep a few things in mind:

1. Do Your Research: Look deeply into a company's numbers, what industry it's in, and how it's growing. Doing this research can help you make informed decisions.

2. Diversification: The age-old advice of not putting all your eggs in one basket holds true here. Diversifying your investments across multiple small-cap stocks hedges your risk. If one stock falters, the potential losses are offset by the successes of others. Spreading out your investments lowers your risk and makes it more likely you'll make money overall.

3. Long-Term Perspective: While the seas may get choppy in the short term, small-cap stocks have historically shown resilience and potential for long-term growth. A patient approach can help you ride out the stormy periods and capitalize on the promising opportunities for expansion.

In the end, small-cap stocks are a world of excitement and uncertainty, where risks and rewards mix together in a complicated way. Even though the journey can be a bit wild, investors who like the idea of growing their money and supporting new ideas often want to be a part of it. If you do your research, spread out your investments, and are willing to wait, you might be able to turn the risk of small-cap stocks into a chance for much higher returns.

Responses (0 )