Shubha Dasgupta

Chief Executive Officer, Co-Founder & Director

Shubha Dasgupta is the CEO and Co-Founder of Toronto-based Pineapple, a leading mortgage industry disruptor. Since joining the mortgage industry in 2008, Shubha has focused on leveraging technology while prioritizing customer experience to transform the sector. His unique vision and expertise have been instrumental in building and growing Pineapple, which boasts over 700 brokers in its network today.

Under Shubha's leadership, Pineapple has developed a world-class, data-driven Enterprise Management platform that offers a personalized experience for clients, making it the first full-circle mortgage process for agents. His deep understanding of business and industry trends, combined with his ability to drive best-in-class customer experience and profitability, has allowed him to infuse vision and purpose in his professional endeavors throughout his career.

An award-winning executive and seasoned industry expert, Shubha has been recognized among the top executives in the mortgage industry. He was included in the '2020 and 2022 Mortgage Global 100' for inciting positive change and growth in the field. Additionally, he has been featured in the annual Canadian Mortgage Professional's Hot List for five consecutive years since 2018. In 2021, he was appointed President of the Canadian Mortgage Brokers Association (CMBA) Ontario Board of Directors, following a second year on the Board.

Shubha is also a philanthropic leader who actively engages with various non-profit organizations in the Toronto community. He currently serves on the board of Melanoma Canada and has been a devoted advocate in the fight against cancer since 2010. In 2017, he co-founded CMI Cancer Fighters, a group of Canadian mortgage industry professionals dedicated to fighting cancer. He also serves on the corporate cabinet for the Make-A-Wish Foundation.

Shubha is a highly sought-after public speaker and media expert who frequently speaks on a range of topics, including finance, self-improvement, and philanthropy. His reputation as a thought leader in the mortgage industry and his commitment to customer experience and philanthropy make him a valuable leader and subject matter expert.

Full Interview:

Thank you for taking the time to answer my questions about Pineapple Financial Inc. (PAPL). For our readers who may be unfamiliar, please briefly describe the company and its focus.

Pineapple Financial Inc. (PAPL) is a Canadian mortgage technology company leading the charge in transforming how brokers operate. With a focus on leveraging cutting-edge technology and comprehensive support, we empower brokers to provide Canadians with a seamless digital mortgage experience. Our flagship cloud-based platform, Pineapple, offers end-to-end solutions for mortgage agents, streamlining processes from lead generation to deal management. Emphasizing a people-first approach, we aim to guide all stakeholders into the modern era of mortgages. Our MyPineapple platform integrates seamlessly with industry-leading tools, and we've forged partnerships with major lending institutions like TD Bank and Scotiabank. Pineapple Financial Inc. is committed to revolutionizing the mortgage industry while prioritizing customer experience and collaboration.

How does PAPL stand out from other major mortgage brokerages in Canada? What are your key competitive advantages, especially regarding technology and broker support?

Pineapple Financial Inc. (PAPL) distinguishes itself from other major mortgage brokerages in Canada through a combination of innovative technology and unparalleled broker support. Our key competitive advantages, particularly in technology and broker support, set us apart in the industry.

One of our standout features is our robust data analytics capabilities. We leverage past borrower data to identify opportunities for future re-servicing, enhancing the borrower experience and generating additional revenue. Through proprietary scoring algorithms, our unique customer profiling system segments and profiles borrowers based on their specific needs, resulting in increased conversion rates for our mortgage agents.

Additionally, our internal processing center, empowered by technology, boosts efficiency and capacity in mortgage underwriting. We provide actionable signals to our mortgage agents, alerting them when a borrower is engaged or shows high conversion potential. This enables agents to focus their efforts on high-priority borrowers, enhancing revenue and operational efficiencies.

Furthermore, our approach to knowledge transfer ensures data integrity and maximizes insights. By not relying solely on sales agents to input data, we maintain the integrity of client information, facilitating more accurate analytics and profiling.

Lastly, our commitment to data integrity is upheld by a secure data hierarchy, ensuring the confidentiality and protection of client data throughout its lifecycle.

How is the current Canadian housing market impacting Pineapple's growth strategy? Are you seeing any shifts in borrower demographics or loan types?

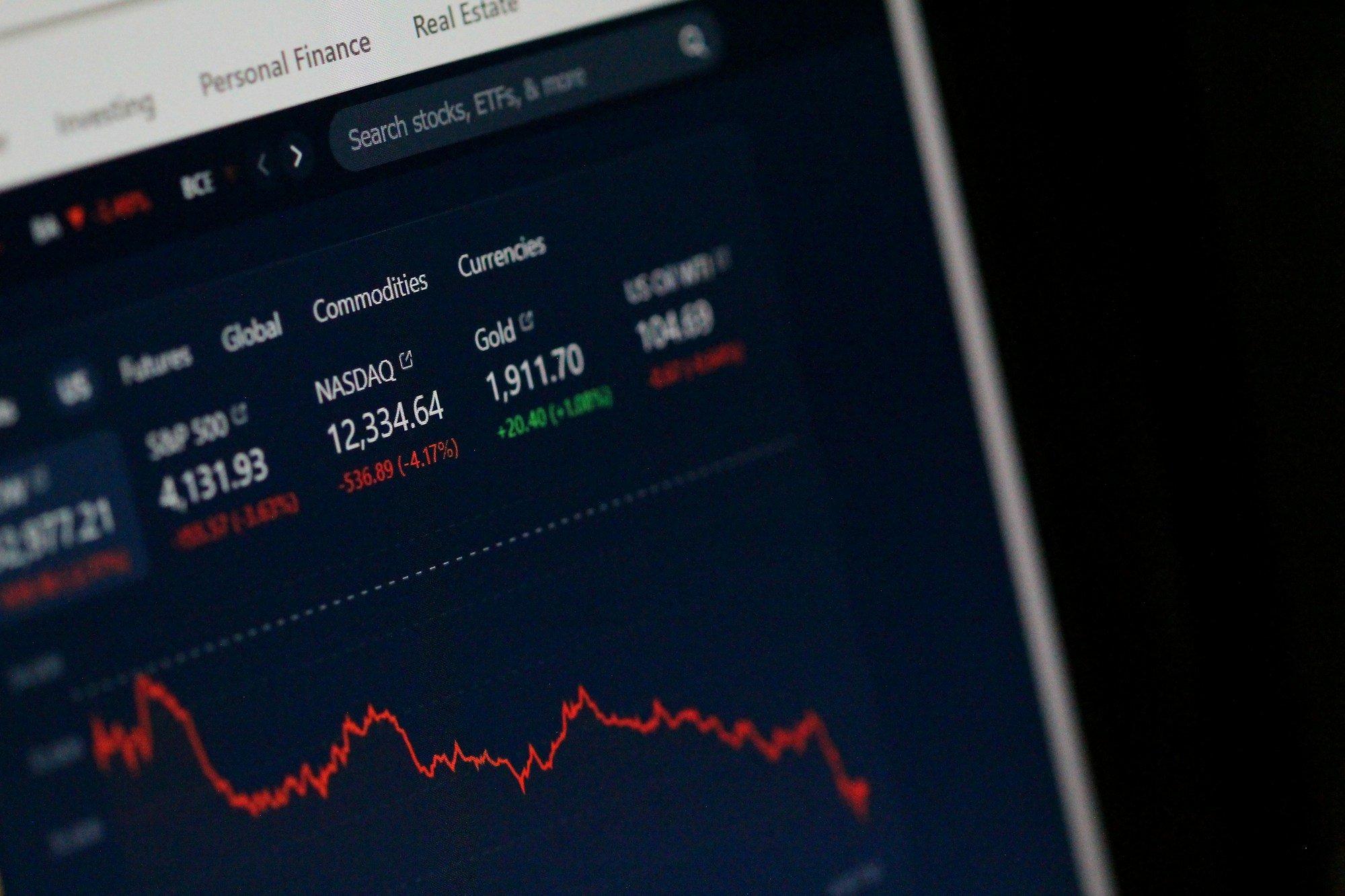

The current landscape of the Canadian housing market has had a notable impact on Pineapple's growth strategy. Initially, during a period of rising interest rates, we observed a slowdown in sales activity, accompanied by a shift in borrower preferences towards shorter-term loan products spanning 1-3 years, as opposed to the more conventional 5-year products commonly seen in Canada. However, the beginning of the current year has marked a significant turnaround, with sales activity experiencing a remarkable surge of over 30% in most major markets nationwide. Anticipated rate cuts by the Bank of Canada, coupled with the majority of existing mortgages nearing maturity, have contributed to this dynamic shift. As a result, industry experts and observers are optimistic about the potential growth opportunities in the coming months and years.

After bringing Mortgage Simplicity on board, could you tell us a bit more about PAPL's plan for growing its network in 2024? Are there particular areas or types of brokerages you're aiming to focus on?

Following the integration of Mortgage Simplicity into our operations, PAPL's strategic vision for network expansion in 2024 is primarily centered on scaling our presence and attracting top-tier professionals within the mortgage brokerage industry. Our historical growth trajectory has largely been organic, showcasing the efficacy of our platform and the success experienced by our brokers. Many of our brokers have established strong relationships within the industry, often affiliating with two or three other brokerages.

As we embark on our journey to scale, we recognize the significance of establishing a strong foothold in key markets across Canada. Our focus will be on bolstering our presence in regions such as Alberta, British Columbia, Ontario, and the Atlantic provinces. By strategically targeting these areas, we aim to further solidify our position as a leading player in the Canadian mortgage industry while providing exceptional support and resources to our network of brokers.

Could you give us an idea of how much Maui, the AI-powered website builder, is expected to boost broker productivity and lead generation? And are there any plans to link up Maui with other parts of the Pineapple platform?

Maui, Pineapple Financial's AI-powered website builder, is poised to significantly enhance broker productivity and lead generation. By leveraging AI technology, Maui enables brokers to create personalized, custom-designed websites within seconds. This streamlined process not only boosts operational efficiency but also enhances search engine optimization (SEO) and lead generation by utilizing unique pages and keywords tailored to each broker's needs.

The introduction of Maui represents the initial phase of a broader initiative to integrate AI throughout the Pineapple platform. As Maui evolves, it will serve as a comprehensive AI assistant, extending its capabilities beyond website creation to various aspects of broker operations, including customer service, product selection, and client retention. By harnessing the power of AI, Maui is poised to revolutionize how mortgages are managed across the country, setting Pineapple Financial apart as an industry leader in technological innovation.

Looking ahead, Maui's development roadmap includes ongoing enhancements and new features designed to further elevate broker efficiency and effectiveness. Pineapple is committed to staying at the forefront of innovation, with plans to unveil a series of AI-driven advancements over the coming year. Through continuous innovation and a dedication to meeting the evolving needs of brokers, Maui represents the future of mortgage brokerage, offering personalized, scalable, and cutting-edge solutions to empower agents both now and in the future.

Beyond Maui, what are some of the key areas of technological innovation the company is focusing on in 2024? How will these advancements benefit both brokers and borrowers?

In addition to the groundbreaking Maui AI-powered website builder, Pineapple Financial is spearheading several key technological innovations in 2024 to revolutionize the mortgage industry. One major advancement is our next-generation deal management software designed to enhance broker productivity and streamline the mortgage process from start to finish. This platform boasts AI-driven document management, secured customer portals, and streamlined document uploads, providing brokers with a highly intuitive and automated approach to client management. Agents can benefit from a range of powerful productivity enhancement tools, including the industry's best user experience, a revolutionary online application pipeline, and a smart document portal. Moreover, the platform's advanced automation features, such as market-dominating automation and productivity-enhancing document submission, revolutionize deal and client management, offering a comprehensive and streamlined solution for every step of the process.

Furthermore, this next-generation system facilitates seamless data flow between critical platforms, accelerating performance and enhancing productivity. The platform syncs effortlessly with Pineapple's core pipeline dashboard, MyPineapple CRM, Connection, and the pre-qualification/online application tool, ensuring consistent and up-to-date data flow. Additionally, it syncs directly with client document portals, Google Drive, Google Email, Transunion, Equifax Credit Bureau, the E-signature tool, and our Payroll platform, providing agents with reliable and current information while simplifying administrative tasks.

Overall, Pineapple Financial's commitment to technological innovation, exemplified by Maui and soon-to-come systems, positions us as industry leaders, empowering brokers with cutting-edge tools to streamline operations, enhance productivity, and deliver an unparalleled customer experience.

With more and more reliance on AI and cloud-based systems, how does the PAPL ensure the security and privacy of client data?

Amidst the increasing reliance on AI and cloud-based systems, Pineapple Financial Inc. (PAPL) places paramount importance on safeguarding the security and privacy of client data. We adopt a multifaceted approach to ensure the protection of sensitive information, starting with the implementation of robust AI and cloud-based systems. These technologies are fortified with advanced encryption protocols and security measures to mitigate potential risks and vulnerabilities.

Moreover, PAPL adheres strictly to industry-leading standards and protocols established for data security and privacy. Our dedicated team of cybersecurity experts continuously monitors and evaluates our systems to identify and address any potential threats or vulnerabilities promptly. We employ state-of-the-art intrusion detection systems and regularly conduct comprehensive security audits and assessments to maintain the integrity and confidentiality of client data.

Furthermore, Pineapple Financial prioritizes ongoing education and training for our staff to instill a culture of security awareness and compliance. All employees undergo rigorous training programs to ensure they understand their role in safeguarding client data and adhere to best practices for data protection.

In addition, we maintain transparent communication with our clients regarding our security measures and privacy policies, providing them with the assurance and peace of mind that their information is handled with the utmost care and diligence.

By prioritizing security at every level of our operations and leveraging cutting-edge technologies and industry best practices, Pineapple Financial ensures that client data remains secure and protected against evolving cybersecurity threats in today's digital landscape.

Following the launch of Maui, do you have any plans to offer similar AI-powered tools directly to mortgage borrowers?

Following the successful launch of Maui, our AI-powered website builder, we are indeed exploring avenues to extend similar AI-powered tools directly to mortgage borrowers. Our ultimate goal is to enhance the mortgage experience for all stakeholders, including borrowers, by leveraging the latest advancements in technology.

While Maui currently focuses on empowering brokers with personalized and efficient websites, we recognize the potential benefits of offering AI-powered tools directly to mortgage borrowers. These tools could range from AI-driven chatbots to virtual assistants designed to assist borrowers throughout the mortgage application and approval process.

By implementing AI-powered tools for borrowers, we aim to provide them with greater convenience, support, and guidance at every stage of their mortgage journey. Whether it's answering questions, providing personalized recommendations, or facilitating document submission, these tools will streamline the borrower experience, ultimately leading to greater satisfaction and efficiency.

As we continue to innovate and expand our technological offerings, we remain committed to delivering best-in-class solutions that meet the evolving needs of brokers and borrowers in the mortgage industry. Therefore, while our immediate focus may be on Maui's integration, we are actively exploring opportunities to introduce AI-powered tools directly to mortgage borrowers in the near future.

After rolling out the eSignature and ad banner software, how are you gauging its effect on broker revenue? Are there plans to introduce additional revenue-generating features within the Pineapple platform?

After the successful rollout of our advanced e-signature and advertising banner software, we are actively monitoring its impact on broker revenue through KPIs tied back to lead generation and customer click-throughs to gauge its effectiveness. Our goal is to continuously improve and optimize our platform to ensure maximum value for our users.

The introduction of advanced e-signature and advertising banners in Pineapple Core brings several benefits to our brokers:

Professional Branding: Brokers can create a professional first impression and boost brand awareness with customized e-signature banners.

Easy-to-Use Interface: Our intuitive interface requires no coding, making it accessible to brokers of all skill levels.

Customer Engagement: Brokers can retain and engage customers by featuring client testimonials, promoting special offers, and encouraging Google reviews directly from their signatures.

Lead Generation: Engaging banners drive traffic back to the broker's website, increasing lead generation and conversions.

Mobile Responsiveness: The e-signature and advertising banners are designed to be mobile responsive, ensuring a cohesive look across all devices.

As for additional revenue-generating features within the Pineapple platform, we are constantly exploring opportunities to enhance our offerings. As we build out other tools and systems that will be widely used we continue to see opportunities for us to increase revenue through strategic methods. We remain committed to introducing new features and functionalities that drive revenue and provide added value to our users. Our goal is to empower brokers with the tools they need to succeed in an increasingly competitive market landscape.

Can you expand on Pineapple's path to profitability? What key factors will drive margin expansion in the coming quarters?

Pineapple is poised for a rapid journey towards profitability in the foreseeable future. Our strategy hinges on multiple key factors that will drive margin expansion in the coming quarters. Firstly, the sustained growth in mortgage volume, coupled with our relentless expansion efforts to capture a larger market share, will significantly boost our top-line revenue. Additionally, the introduction of new revenue streams, such as Pineapple Insurance, promises to be margin-rich, directly impacting our bottom-line performance. Our unwavering focus remains on achieving both scale and margin enhancement. Notably, our current operational expenses are structured to accommodate substantial revenue growth, estimated to be between 6-7 times, before necessitating any substantial changes. This balanced approach ensures a steady path toward profitability while maintaining operational efficiency and sustainable growth.

As the landscape of borrower demographics constantly evolves, could you share any notable trends or shifts that PAPL has observed? And how is the company adapting its strategies to meet these changing needs and trends?

One notable trend we've observed is the increasing demand for digital mortgage solutions and a preference to use mortgage brokers versus going directly to banks. This can be seen especially among younger demographics. Millennials and Gen Z borrowers are increasingly seeking convenient, tech-savvy mortgage experiences that offer transparency and efficiency. To meet these changing needs, PAPL has invested heavily in technological innovation, such as our AI-powered platform and personalized customer portals. We've also expanded our digital marketing efforts to reach younger audiences and enhance our online presence. Additionally, we offer comprehensive training and support to our brokers to ensure they are equipped to serve clients of all demographics effectively.

Can you discuss any strategic partnerships or collaborations that PAPL has formed to enhance its services or expand its reach, therefore driving value?

PAPL has forged strategic partnerships with major lending institutions, including TD Bank and Scotiabank, to enhance our service offerings and expand our reach. These partnerships allow us to offer a wide range of mortgage products and competitive rates to our clients, driving value and increasing customer satisfaction. Additionally, we collaborate with industry organizations, regulatory bodies, and technology providers to stay at the forefront of innovation and best practices. Companies like Salesforce, Microsoft for AI, and Google for cloud management Our exclusive and non-exclusive partnerships with leading real estate agencies like Century 21 Leading Edge and financial advisors also enable us to reach new clients and strengthen our market position.

Can you delve a little deeper into PAPL’s commitment to social responsibility? Are there any specific initiatives or partnerships you'd like to highlight?

At PAPL, our dedication to social responsibility is ingrained in our company culture. We actively contribute to our community by supporting various charitable organizations and initiatives through donations, volunteer work, and fundraising campaigns. In addition to our commitment to diversity, equity, and inclusion within our organization, we strive to create a workplace that fosters support and inclusivity for all employees. Notably, we have directly raised over $100,000 for the Canadian Cancer Society and donated proceeds from each mortgage closed. Moreover, our volunteers have dedicated over 5,000 hours to the Canadian Cancer Society, $15,000 to the Centre For Addiction And Mental Health (CAMH), and volunteered over 100 hours to this cause. Similarly, we have contributed $50,000 to Maple Leafs Sports & Entertainment (MLSE) for youth sports and programs through our Pineapple March Madness 3-on-3 basketball tournament. Additionally, we have donated $25,000 to Princess Margaret Ride to Conquer Cancer, where our Pineapple bike riders raise funds while participating in the charity ride. Our ongoing commitment to social responsibility reflects our core values, and we continuously seek opportunities to positively impact the communities we serve.

What are your long-term goals for the company, and how do you envision PAPL evolving in the next few years?

Our long-term goals for PAPL include becoming the leading mortgage technology company in Canada, expanding our market share, and continuing to innovate and disrupt the industry. We aim to further grow our broker network, enhance our technology platform, and provide unparalleled support and value to our clients and partners. In the next few years, we envision PAPL evolving into a comprehensive mortgage solutions provider, offering a wide range of products and services to meet the diverse needs of Canadian borrowers. We will continue to adapt to market trends, invest in technology, and prioritize customer satisfaction to drive sustainable growth and success.

Is there any other information you wish to share with our investors so we can highlight the key investment opportunities for Pineapple Financial?

We invite investors to join us on our journey to revolutionize the mortgage industry and shape the future of finance in Canada. With our innovative technology platform, strong market position, and commitment to excellence, PAPL is poised for significant growth and success in the years ahead. We believe that investing in PAPL offers a unique opportunity to participate in the transformation of one of the largest and most important sectors of the Canadian economy. Thank you for considering Pineapple Financial as a potential investment opportunity, and we look forward to welcoming you to our investor community.

Thank you for your time.

Responses (0 )