Smartsheet (NASDAQ:SMAR), a leading provider of workplace collaboration software, has recently become a potential acquisition target for a private equity consortium led by Vista Equity Partners and Blackstone. Smartsheet's software enables organizations to manage, track, and automate workflows on a single platform, making it a critical tool for large corporate clients, including several Fortune 500 companies. While the company has demonstrated strong revenue growth, reporting $276.4 million in Q2, it continues to operate at a loss, with a net loss of $8.9 million for the quarter. Despite these losses, Smartsheet's recurring revenue model and expansion in enterprise accounts make it an attractive investment for private equity firms. Let us take a closer look at Smartsheet’s business and evaluate both, the risks and opportunities for potential acquirers.

Strong Enterprise Adoption and Recurring Revenue Model

One of the most compelling reasons why Smartsheet has attracted interest from private equity giants is its robust enterprise adoption and recurring revenue model. The company’s annualized recurring revenue (ARR) now stands at $1.093 billion, with over 15.3 million users globally. Smartsheet has been able to expand its presence in large organizations, with 77 customers now contributing over $1 million each in ARR, a 50% increase compared to the same period last year. Moreover, the platform serves major corporations such as Intuit and SKECHERS, emphasizing its ability to handle complex, large-scale operations. Smartsheet’s focus on enterprise-grade security and scalability has made it the preferred choice for corporate IT departments, enabling organizations to adopt the platform across multiple teams and departments. The company’s recurring revenue model, particularly with its expanded enterprise customer base, offers financial stability and predictability, which is highly appealing to private equity investors. Large enterprise customers typically lock into multi-year contracts, providing a steady stream of income for Smartsheet, reducing the volatility in its earnings. The recurring nature of its revenue, combined with its ability to upsell premium capabilities like AI-powered tools, positions Smartsheet as an attractive target for private equity firms looking to drive long-term value creation through operational improvements and growth scaling.

Impressive Free Cash Flow Growth and Profit Margin Expansion

Smartsheet’s recent financial performance, particularly its free cash flow growth, is another key factor making it an attractive buyout target for private equity firms like Vista and Blackstone. The company generated $57.2 million in free cash flow in Q2, a notable increase from $45.7 million in the same quarter the previous year. This represents a free cash flow margin of 21%, showcasing the company’s ability to convert its strong revenue growth into positive cash flow. Additionally, Smartsheet has been actively working to improve its profit margins. The company’s gross margin was a solid 84% in Q2, while its subscription gross margin reached 87%. Despite operating losses, Smartsheet is on a trajectory to achieve profitability by focusing on high-margin subscription revenue and optimizing its pricing models. The recently introduced pricing and packaging model is designed to increase the company’s revenue per user, which could significantly improve margins over time. Private equity firms typically seek companies with strong cash flow generation potential, as it allows them to use leverage to finance acquisitions and drive returns. Smartsheet’s consistent improvement in free cash flow, combined with the potential for further margin expansion through its new pricing strategies, makes it an attractive target for buyout firms looking to enhance profitability through operational efficiencies and financial restructuring.

Growth Opportunities in AI and Platform Modernization

Another driver that makes Smartsheet appealing to private equity firms is its ongoing platform modernization and integration of AI-powered features, which present significant growth opportunities. The company has already launched new AI-driven tools, such as formula generation and text summaries, which are designed to streamline complex tasks, saving time and reducing errors for users. In Q2, Smartsheet saw a 50% sequential growth in the number of users utilizing its AI tools, with approximately 47,000 users saving an estimated 1 million hours through AI automation. Smartsheet’s ability to leverage AI to enhance its platform not only improves user experience but also strengthens customer retention by embedding advanced features that customers are unlikely to find elsewhere. Additionally, Smartsheet is working on modernizing its platform to make it more powerful and integrated, which will further increase its appeal to enterprise clients. By improving the platform’s scalability and ease of use, Smartsheet can attract more large customers, thereby increasing its ARR. For private equity firms, the ability to invest in these technological advancements represents a clear path to growth. AI and platform modernization efforts can drive higher customer satisfaction, increase user adoption, and create upselling opportunities, all of which can contribute to revenue growth and a higher valuation in the long term. Smartsheet’s focus on innovation and the modernization of its platform provide a strong foundation for future growth, making it an attractive target for private equity investors looking to capitalize on technological advancements and market expansion.

Final Thoughts

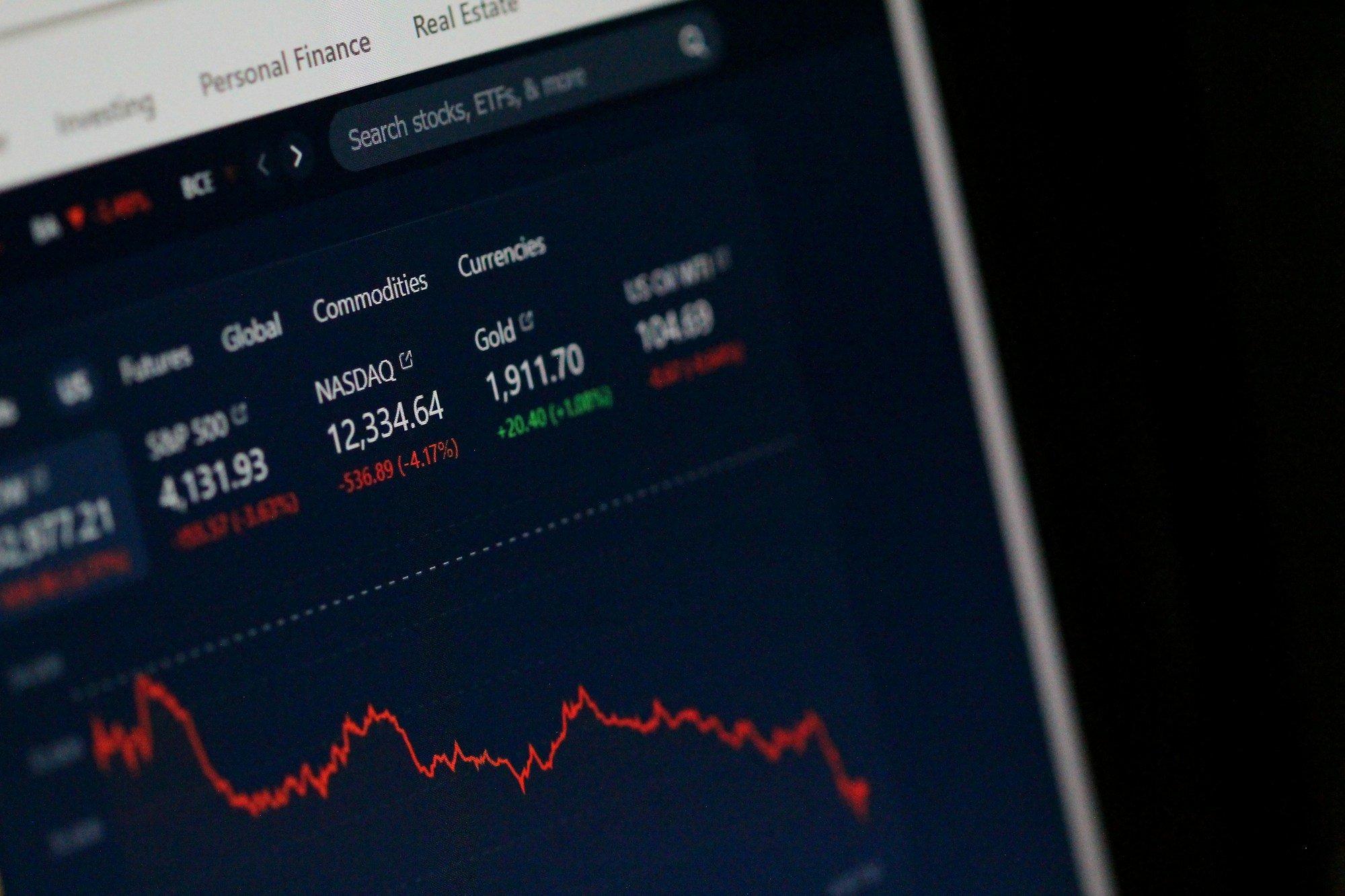

Source: Yahoo Finance

Smartsheet has been grabbing the interest of potential acquirers for quite a few months which is why we see an upward trajectory in the stock price along with extreme volatility. The company does present a unique opportunity for private equity firms like Vista and Blackstone to acquire a growing enterprise software company with significant potential for scalability and profitability. Overall, we believe that strong enterprise adoption, growing free cash flow, and advancements in AI-driven features position it as an appealing buyout target. However, investors should remain cautious of the challenges Smartsheet faces, including its reliance on large enterprise customers and the increased churn in smaller segments. While the company’s growth prospects are promising, particularly with its platform modernization efforts, the risks associated with its current financial performance and market competition should not be overlooked, especially by investors looking for a short-term M&A-related upside on the company.